Everything You Need to Know About Importer Exporter Code (IEC) Certificate

An Importer Exporter Code (IEC) is a 10-digit unique code issued by the Directorate General of Foreign Trade (DGFT) that businesses must obtain to import or export goods and services in India. This code facilitates smooth customs clearance and allows businesses to access government subsidies and export incentives. The application process for an IEC is straightforward and can be completed online by submitting documents such as a PAN card, business address proof, and bank details. Once issued, the IEC remains valid for a lifetime without requiring renewal. It opens up opportunities for global trade and growth, making it essential for businesses looking to expand their reach internationally.

What is an Importer Exporter Code (IEC) Certificate?

Why is IEC Certificate Important for Businesses?

The Importer Exporter Code (IEC) certificate is crucial for businesses engaged in international trade as it serves as a mandatory requirement for importing or exporting goods and services. Here’s why an IEC certificate is important for businesses:

- Legal Requirement: It is mandatory for importing and exporting goods and services.

- Customs Clearance: It facilitates smooth customs clearance during international trade.

- Access to Government Benefits: It enables businesses to access export incentives, subsidies, and schemes.

- Global Trade Expansion: It opens doors to international markets and global supply chains.

- Financial Transactions: It is required for international payments and agreements with foreign clients.

- Lifetime Validity: Once issued, the IEC remains valid for a lifetime without renewal.

- Credibility and Trust: It enhances business reputation and trust with international partners.

In conclusion, the IEC certificate is an essential document for any business looking to engage in global trade. It offers numerous benefits, including access to government schemes, smoother customs processes, and enhanced business credibility.

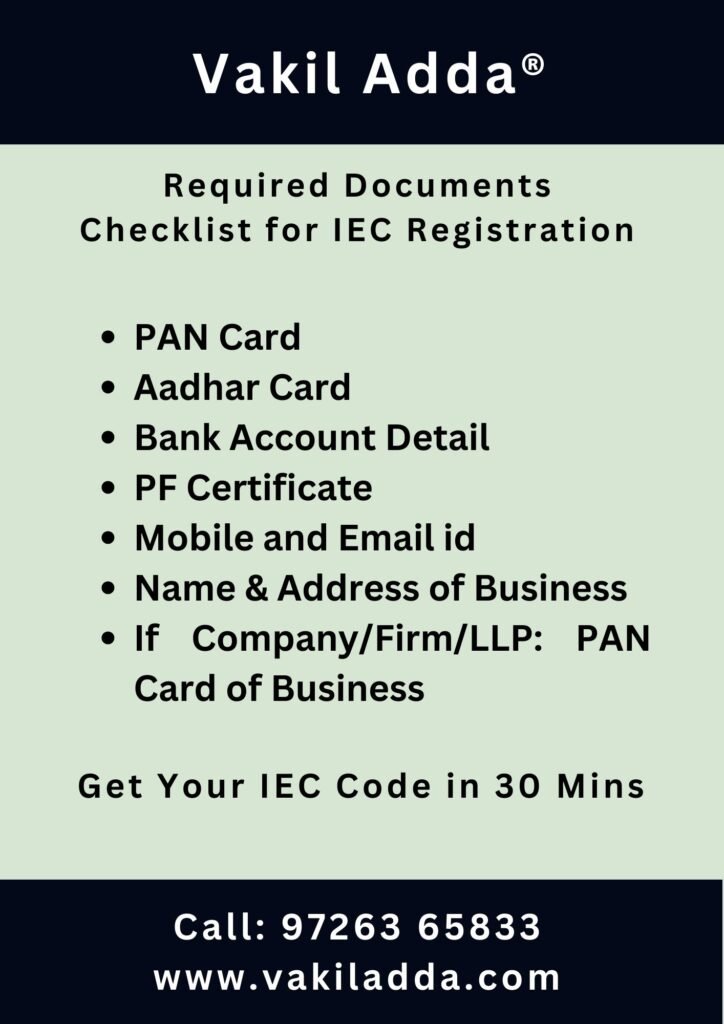

Eligibility and Documents Required for IEC Registration

Eligibility:

- Business Type: Any individual, company, partnership, or other legal entities involved in importing or exporting goods or services from India.

- No Minimum Turnover Requirement: No minimum turnover is required to apply for an IEC.

- Indian Resident: The applicant must be an Indian resident; foreign entities must apply through a branch or representative in India.

Documents Required:

- PAN Card of the applicant (individual or business entity).

- Proof of Business Address (utility bill, rent agreement, or any valid document showing the business address).

- Bank Account Details: A canceled cheque or a bank certificate with the business’s bank account number and IFSC code.

- Identity Proof of the applicant (Aadhar card, passport, voter ID, or driving license).

- Partnership Deed (if the business is a partnership).

- Certificate of Incorporation (for companies).

- Authorization Letter (if someone else applies on behalf of the business).

After submitting the necessary documents and processing the application through the DGFT portal, the IEC is typically issued within a few days.

Step-by-Step Guide to Applying for an IEC Certificate

Applying for an Importer Exporter Code (IEC) certificate is a simple and straightforward process. Follow this step-by-step guide to get your IEC registered:

Step 1: Visit the DGFT Portal

- Go to the Directorate General of Foreign Trade (DGFT) official website: www.dgft.gov.in.

- Register by creating a user account on the portal if you don’t already have one.

Step 2: Log in to Your Account

- Log in to your account using your credentials once registered.

Step 3: Complete the IEC Application

- After logging in, click on the “IEC Application” tab in the menu.

- Fill in the application form with accurate details about your business, such as name, type of entity, address, and the nature of the business.

Step 4: Upload the Required Documents

- Upload the necessary documents, including:

- PAN Card of the applicant or business.

- Proof of Business Address (utility bill, rental agreement, etc.).

- Bank Account Details (cancelled cheque or bank certificate).

- Identity Proof (Aadhar card, passport, or other valid IDs of the applicant).

- Partnership Deed (if applicable) or Certificate of Incorporation (for companies).

- Authorization Letter (if applying on behalf of the business).

Step 5: Pay the Application Fee

- Pay the nominal application fee online via the portal using debit/credit cards or other payment methods.

Step 6: Submit the Application

- Once all the details are filled in and documents are uploaded, submit your application online.

Step 7: Application Processing

- After submission, the DGFT will process your application. The IEC certificate will typically be issued within a few business days, provided all details and documents are correct.

Step 8: Download the IEC Certificate

- Once the application is approved, download the IEC certificate in PDF format and print it for your records.

Step 9: Use the IEC for International Trade

- Use the IEC for all your import and export activities, including customs clearance, payments, and documentation.

Validity and Renewal Process of IEC Certificate

The Importer Exporter Code (IEC) certificate is a crucial document for businesses engaged in international trade. It allows businesses to legally import and export goods and services. Here’s an overview of its validity and renewal process:

Validity of IEC Certificate

The IEC certificate is valid for a lifetime once issued, and it does not require periodic renewal. Unlike other registrations or licenses, the IEC does not have an expiration date. However, businesses are required to update certain details if there are significant changes to the firm or its activities.

When to Update IEC Details?

While the IEC certificate itself does not expire, businesses must update their IEC details if:

- There is a change in the business structure (e.g., from a sole proprietorship to a partnership or a company).

- The business address changes.

- The authorized signatory or bank details change.

- There is a merger or acquisition involving the business.

To update details, businesses need to submit a request to the Directorate General of Foreign Trade (DGFT) through the official portal.

IEC Renewal Process

Although there is no mandatory renewal process for an IEC certificate, businesses must:

- Update Information: Ensure that the IEC details are up to date with DGFT whenever there is a significant change.

- Revalidate IEC: If the business is non-operational for an extended period, revalidation may be necessary when resuming import-export activities.

Penalties for Non-Compliance

If a business fails to update its IEC details, it may face difficulties in carrying out import or export transactions, as customs authorities and other government agencies may rely on accurate, up-to-date information for clearance and other activities.

Benefits of Having an IEC Certificate for Importers and Exporters

The Importer Exporter Code (IEC) certificate is essential for businesses involved in international trade. Issued by the Directorate General of Foreign Trade (DGFT), this 10-digit code authorizes businesses to legally import and export goods and services. Here are some key benefits of having an IEC certificate:

Legal Authorization for International Trade

The IEC certificate authorizes businesses to engage in import and export activities. Without it, businesses cannot clear customs, make international payments, or receive shipments. Obtaining an IEC ensures compliance with government regulations for cross-border trade.

Access to Government Benefits

The IEC certificate allows businesses to access various government schemes, subsidies, export incentives, and international marketing assistance. Registered importers and exporters can tap into government-supported programs to grow their businesses and expand globally.

Enhanced Credibility

Having an IEC certificate boosts a business’s credibility with international clients, suppliers, and financial institutions. It assures them that the business follows legal and tax obligations, making it easier to establish trust and form strong business relationships.

Facilitation of Smooth Customs Clearance

The IEC certificate is required to clear goods through customs at ports, airports, and land borders. It streamlines the clearance process, ensuring goods can be imported or exported without delays.

Simplified International Transactions

An IEC certificate simplifies cross-border transactions. It enables businesses to open foreign currency accounts, handle international payments, and make import/export transactions efficiently while ensuring compliance with customs and foreign exchange regulations.

Easy Access to Finance

Financial institutions and banks prefer dealing with registered importers and exporters. Having an IEC certificate makes it easier for businesses to obtain trade credit, secure loans, and receive financial support to expand international operations.

Export Documentation

The IEC certificate is necessary for creating export documentation such as shipping bills, export invoices, and bills of entry. It helps businesses meet legal requirements for exporting goods and ensures smoother export operations.

Common Issues in IEC Registration and How to Resolve Them

Incorrect or Incomplete Documents: Ensure all required documents, such as PAN card, address proof, and identity proof, are accurate and uploaded correctly.

PAN Card Mismatch: Verify that the details on the PAN card match the business registration documents. Update PAN details if necessary.

Inactive or Incorrect Bank Account Details: Double-check that the bank account provided is active and in the business’s name, and submit the required proof.

Business Structure Changes: Provide updated business registration documents if the business structure changes (e.g., sole proprietorship to partnership).

Invalid Business Address: Ensure the address proof matches the details in the registration form, using valid documents like utility bills or lease agreements.

Delays in DGFT Portal: In case of technical issues, try submitting during off-peak hours or contact DGFT support.

Non-Compliance with Legal Requirements: Ensure your business meets all legal and tax requirements before applying.

Incorrect Name on IEC: Review the IEC certificate after issuance and request corrections from DGFT if necessary.

By ensuring accuracy and compliance, businesses can avoid delays and easily complete their IEC registration.

How IEC Certificate Facilitates Global Trade Opportunities

The IEC (Import Export Code) certificate is a vital requirement for businesses engaged in international trade. The Directorate General of Foreign Trade (DGFT) issues it, allowing companies to legally import and export goods and services. This certificate ensures smooth customs clearance, eliminating delays in the trade process. By obtaining an IEC, businesses can expand their reach to global markets and establish themselves as credible entities in international trade. It opens doors to trade benefits such as subsidies, tax rebates, and government incentives, supporting growth and profitability. Additionally, the IEC certificate builds trust with foreign buyers and suppliers, facilitating secure transactions and partnerships. It enables businesses to engage in cross-border collaborations, joint ventures, and strategic alliances, further enhancing their presence in global markets. In summary, the IEC certificate serves as a crucial tool for businesses aiming to thrive in international trade and expand their operations globally.

How to Solve IEC-Related Queries and Get Support

- Visit the DGFT Website – Access official guidelines, FAQs, and circulars related to IEC.

- Contact DGFT Helpdesk – Get direct assistance via phone or email for IEC-related queries.

- Reach Out to Customs Authorities – Seek help regarding customs clearance and shipment issues.

- Consult Trade Experts – Get professional advice for applying, renewing, or addressing IEC discrepancies.

- Utilize Online Forums – Join trade communities for peer support and practical solutions.

- Seek Assistance from Chamber of Commerce – Leverage resources and support for IEC-related matters.

How IEC Certificate Facilitates Global Trade Opportunities

The IEC (Import Export Code) certificate is a key facilitator for businesses seeking to explore global trade opportunities. Here’s how it benefits international trade:

Mandatory for International Trade: The IEC is a compulsory requirement for businesses involved in importing and exporting goods or services. It acts as a unique identification number for the business, ensuring compliance with India’s foreign trade regulations.

Enables Access to Global Markets: With an IEC, businesses can expand their reach to international markets. It allows them to legally engage in global trade by facilitating the import and export of goods and services.

Simplifies Customs Procedures: The IEC certificate streamlines customs clearance, ensuring faster processing at ports and customs offices. This reduces delays, making international transactions smoother and more efficient.

Boosts Credibility: Having an IEC certificate enhances a business’s credibility with international clients and suppliers. It assures foreign partners that the business is registered and legally authorized to trade across borders.

Eligibility for Trade Benefits: Businesses with an IEC certificate can avail themselves of various trade incentives, such as tax rebates, subsidies, and other government benefits designed to support international trade and export promotion.

Opens Networking Opportunities: The IEC helps businesses establish connections with foreign companies, distributors, and agents. This fosters collaboration and opens doors to new business relationships and market expansion opportunities.

In conclusion, the IEC certificate is essential for businesses aiming to thrive in international trade. It ensures legal compliance, improves business credibility, facilitates trade procedures, and unlocks various growth opportunities in global markets.

Key Takeaways on the Importance of IEC for International Trade

The IEC (Import Export Code) is more than just a legal necessity—it’s a gateway to international trade. This essential certificate unlocks global market access, enabling businesses to import and export goods effortlessly. It simplifies customs procedures, ensuring smooth cross-border transactions with minimal delays. An IEC also elevates a business’s credibility, establishing it as a trusted player in the global market. With this certificate, companies can access government trade benefits like tax incentives and subsidies, fueling growth and expansion. It also opens the door for valuable international partnerships and collaborations. In essence, the IEC serves as the key to transforming local businesses into global players.