Gujarat Labour Welfare Board Registration

Are you looking for Gujarat Labour Welfare Board Registration? Get Labour Welfare Fund Registration consultancy with Vakil Adda. We provide a comprehensive solution for Gujarat Labour Welfare Board Registration and return filing. Get your GLWB Registration within 5 days. Connect with us now!

Looking for Gujarat Labour Welfare Fund Consultant?

Gujarat Labour Welfare Board Consultant

As per The Gujarat Labour Welfare Fund Act, 1953, and The Labour Welfare Fund (Gujarat) Rules, 1962 GLWF Applicable to all employer/establishment working with 10 or more employee/person. The Gujarat Labour Welfare Board (GLWB) plays a pivotal role in ensuring the well-being of laborers across the state. Under the Gujarat Labour Welfare Fund Act, the GLWB oversees various rules, schemes, and benefits tailored for laborers and their families. From healthcare to education, housing to skill development, the GLWB offers a range of welfare schemes aimed at enhancing the lives of laborers. Employers falling under the Act’s purview are mandated to register with the GLWB and contribute to the Labour Welfare Fund, ensuring the sustainability of these initiatives. The Act applies to a wide array of establishments, including factories, mines, construction sites, and shops, emphasizing the importance of collective welfare in Gujarat’s workforce.

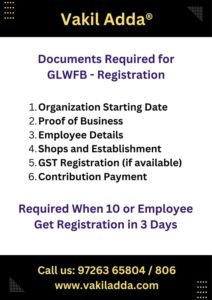

To facilitate registration, the GLWB has streamlined the process for employers seeking to join the initiative. By submitting requisite documents and details, employers can easily register online through the official website or authorized service providers. This process not only ensures compliance with the Act but also enables employers to actively participate in enhancing the welfare of laborers. Through collaboration and adherence to registration requirements, both private and public sector establishments contribute to the larger goal of fostering a supportive and inclusive environment for Gujarat’s workforce, thereby strengthening the foundation of the state’s labor welfare initiatives.

Contribution of welfare fund required to submit half yearly, Rs. 18 per employee. If you are in requirement of GLWF Registration, Consult us now.

Applicability of Gujarat Labour Welfare Fund

Following Entity/Employer required to get Labour Welfare Fund Registration

- Establishment/Employer working with 10 or more employees in

Contribution of Gujarat Labour Welfare Fund

Half Yearly Contribution required to submit to GLW Board as per following rates

- Employee Contribution: Rs. 6 Per Employee (Half Yearly)

- Employer Contribution: Rs. 18 Per Employee (Half Yearly)

Submission of Return of GLW – Half Year Cycle

- January to June: Deduction Date 30th June, Payment Must be done before 15th July.

- July to December: Deduction Date 31st December, Payment must be done before 15th January.

Charges of Gujarat Labour Welfare Fund Registration

Our Consultancy Fees for GLWF Registration is Rs. 5000/-.

Process of GLWF Registration - Get in 5 Days

Filing of Return of GLWB Fund Payment

Consultancy Charges for Filing of GLWF Return: Rs. 1000 Per Six Month Cycle.

GLWF Registration Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: GLWF Registration Consultant | GLWF Registration Consolidated Package