Computation of Income

Have you applied for a bank loan, insurance, immigration, etc., and your agent or company is requesting a Computation of Income (COI)? Don’t worry at all; we provide the Computation of Income for your filed Income Tax Return. The Computation of Income serves as a summary of your ITR, encompassing key details, income sources, and tax information. Typically, both the Income Tax Return and COI are required for purposes such as bank loans, finance, and insurance applications. We offer Chartered Accountant UDIN certified ITR and its COI, delivered within 30 minutes, serving clients across India.

Get CA Certified COI of ITR - In Just 30 Mins

Computation of Income (COI) Preparation

In simple terms, the Computation of Income is a document prepared based on your Income Tax Return. It’s also known as Tax Computation, Income Computation, or COI. This document is a simplified version that contains the essential elements of your Income Tax Return. The government’s official Income Tax Return Document has a lot of information, data, and complex computations based on sections of the income tax act, making it hard to understand.

Our Computation of Income preparation service removes unnecessary details and generates a summarized Income Statement that is easy to understand. Generally, COI includes Income Sources, Tax Computations, Deductions, Investments, Profit or Loss, and details about the personal taxpayer. We take pride in being the only Indian consultancy firm that provides the Computation of Income Statement completely online in just 30 minutes. Additionally, we can provide you with a CA Certified Computation of Income with UDIN Generation for added credibility.

Online Computation of Income - Rs. 750 Per Year

We provide Online Service for COI Preparation and ITR Certification.

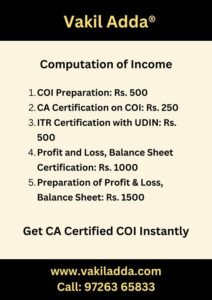

Charges are as

- COI Preparation: Rs. 500 Per Year

- CA Certification on COI: Rs. 250 Per Year

- ITR Certification with UDIN: Rs. 500 Per Year

- Profit and Loss, Balance Sheet Certification: Rs. 1000

- Preparation of Profit and Loss, Balance Sheet: Rs. 1500

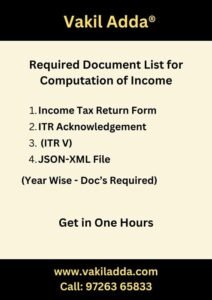

What Are the Documents Required for Computation of Income Preparation?

Usage of Computation of Income (COI)

COI Can be useful for

- Bank Loan Purpose

- Health Insurance Policy

- Term Insurance Policy

- Home Loan

- Visa Approvals

- Any other place where you need to show your income.

Obtain CA Certified COI in 30 Mins

Send us relevant document for Generation of COI. Such Documents can be sent via email office@vakiladda.com or via WhatsApp +91 9726365833.

After that, we will send draft copy of COI. Once you approve draft our CA will process for final generation with UDIN.

You will receive the CA Certified COI within 30 minutes, and we also provide nationwide courier dispatch services.

Normal COI vs CA Certified COI

Income Tax Return is the prima facie document for the preparation of the Computation of Income. After the preparation of the COI, one can use such a document. However, for more authentication and assurance, a company/agency/insurance company/bank will ask for CA Attestation on the COI. Thus, CA Certified COI is just the attestation, seal, and signature of a Chartered Accountant over the COI document.

CA Certified COI with UDIN Means?

UDIN is Unique Document Identification Number Generated by Chartered Accountant while doing any kind of Certification Issuance. On COI Certification CA will generate UDIN accordingly.

Computation of Income Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: Computation of Income Consultant | Computation of Income Consultant Consolidated Package

Frequently Asked Questions on COI

Yes, COI Generation and Certification is completely online.

Yes, Once we provide Scan copy. we also dispatch courier for your door step delivery Across India.