Property TDS Payment Consultant

Are you searching for a Property TDS Payment Consultant? We offer a comprehensive TDS solution for property payments. Gain relevant information about property TDS requirements, the payment process, Form 16 generation, rules for NRIs (Non-Resident Indians), and consultancy services related to TDS. If you need a Property TDS Consultant, connect with us. We provide Property TDS return filing services across India.

Looking for Property TDS Consultancy?

Property TDS Payment

As per The Income Tax Act, 1962 Immovable Property Transaction falls in the ambit of Section 194IA TDS Deduction. As per the Rule Any Immovable Property Transaction which is having transaction value higher than threshold limit (Currently Threshold is Rupees Fifty Lakhs) required to Deduct 1% TDS. Buyer of Property required to deduct payment from the seller portion and deposit the same as TDS on Property by Filing of Form 26QB. If property Purchased on Installment Basic then each installment required to deduct TDS. Such Payment of TDS required to deposit within 30 Days of Deduction.

In Case of Seller is NRI (Non-resident India) then Form 26QB will not be applicable. In That case, Buyer need to deduct tax based on Long Term Capital Gain (20%) and Short Term Capital Gain (as per Tax Slab). For Filing of NRI Deducted TDS, TAN is required.

If you are searching of Property TDS Consultant, Then Vakil Adda is best suitable place as your Property TDS Payment Consultant.

Fees for Filing of 26QB - Property TDS Return

Online Property TDS Payment 26QB Filing Fees Rs. 2000/-

Property TDS (NRI) Compliance: Rs. 5000/-

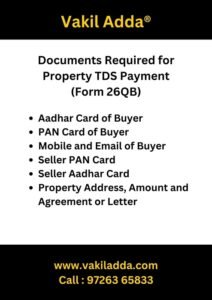

What Are the Documents Required for Filing of 26QB Property TDS?

Applicability of Property TDS Deduction

Property TDS Compliance Required to follow if Property Value is More than Rs. 50 Lakhs. In Case on NRI there is no threshold limit.

Property TDS in Case of NRI Seller

Where Non-Resident Indian is selling Property TDS Compliance differs from regular 26QB Payment. In Case of NRI, 20% TDS Amount required to deduct if property is long term. Such need to be filed via regular TDS Return with TAN (of Buyer).

Process of Filing 26QB - Property TDS Payment

Form 16 Generation of Property TDS

Form 16B is used to provide evidence of tax deducted at source (TDS) on property transactions under section 194IA of the Income Tax Act, 1961. Section 194IA mandates the deduction of TDS by the buyer of the property at the time of payment to the seller. Here’s how Form 16B is generated for property TDS under section 194IA:

TDS Deduction by Buyer (Payer): As per section 194IA, when a buyer (payer) makes payment to a resident seller for the transfer of immovable property (other than agricultural land) exceeding Rs. 50 lakhs, the buyer is required to deduct TDS at the rate of 1% on the total sale consideration.

Deposit of TDS by Buyer: After deducting TDS, the buyer is required to deposit the deducted TDS amount to the government within the stipulated time frame.

Generation of Form 16B:

- The buyer needs to visit the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website (https://www.tdscpc.gov.in/app/login.xhtml) and log in using their TAN (Tax Deduction and Collection Account Number).

- Once logged in, the buyer can go to the “Downloads” section and select “Form 16B.”

- Fill in the required details such as PAN (Permanent Account Number) of the seller, assessment year, and acknowledgment number of the TDS return filed.

- After providing the necessary details, the buyer can request the generation of Form 16B.

Verification and Download: After the request is submitted, Form 16B will be generated online. The buyer needs to verify the details and download the Form 16B.

Providing Form 16B to Seller (Payee): Once Form 16B is downloaded, the buyer needs to provide it to the seller (payee) as proof of TDS deduction on the property transaction.

Filing Income Tax Return by Seller: The seller can use Form 16B as proof of TDS deducted while filing their income tax return. They need to include details of the property sale and TDS deduction in their return.

Property TDS Payment Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: Property TDS Payment Consultant | Property TDS Payment Consolidated Package

FAQ's on Property TDS Payment

Yes, Multiple Buyer required to file 26QB of their own portion of property. There is no consolidated form scheme for property tds filing.