Society Audit by CA

Are you looking for a Society Audit by a CA? We provide Chartered Accountant Audit Services for Cooperative Societies across India. Explore here the requirements of Society Audit, the Chartered Accountant’s role in Society Bookkeeping and Audit, necessary documents, and the Audit process. If you need an Auditor for a Cooperative Society anywhere across India, connect with us now.

Looking for Co-operative Society Auditor?

Co-operative Society Audit

In India, the audit of a Cooperative Society is governed by various laws, regulations, and guidelines, with the Chartered Accountant audit of society playing a pivotal role. The Cooperative Societies Act serves as the cornerstone, though its specifics may differ across states. It delineates the rules and procedures for the audit of these societies, ensuring uniformity and adherence to legal standards. Central to this framework is the mandatory audit requirement, compelling every Cooperative Society to undergo an annual audit. This essential process guarantees transparency, accuracy, and compliance with the myriad laws and regulations governing Cooperative Societies.

A critical aspect of Cooperative Society audit is the appointment of an auditor, often a qualified Chartered Accountant (CA) or a reputable firm of Chartered Accountants. The presence of a CA in Co-operative Society audit not only ensures expertise but also emphasizes independence and impartiality throughout the auditing process. Following the audit, the appointed auditor meticulously prepares an audit report, encompassing vital aspects such as financial statements, adherence to legal norms, internal controls, and any pertinent matters. Subsequently, the audited financial statements and the comprehensive audit report are diligently submitted to the Registrar of Cooperative Societies within the specified timeframe, aligning with the mandates set forth by the Cooperative Societies Act and relevant regulations.

Fees & Package of Society Audit Service by CA

We provide Co-operative Society Audit Service Combo Package Starting at Rs. 10,000 Which Includes

- Preparation of Accounts

- Chartered Accountant Audit Report for Society Audit

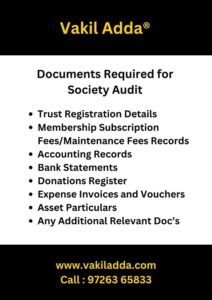

What Are the Documents Required for Co-operative Society Audit?

For Cooperative Society audit, the requisite documentation resembles the following checklist:

- Trust Registration Details

- Membership Subscription Fees/Maintenance Fees Records

- Comprehensive Accounting Records

- Bank Statements

- Donations Register

- Expense Invoices and Vouchers

- Asset Particulars

- Any Additional Relevant Documentation (if applicable)

Applicability and Criteria of Society Audit

As per the State Society Law (based on the location of the society within the state), the audit requirement is mandatory and must be conducted in accordance with the State Society Act.

Process of Co-Operative Society

You need to send us document for CO-OP Society.

Our CA will conduct audit based on documents.

After that, we will file Audit report to relevant Authority.

Types of Co-Operative Society and Audit Requirement

Here’s a breakdown of different types of Cooperative Societies along with their audit requirements:

Consumer Cooperative Society:

- Audit Requirement: Consumer Cooperative Societies typically require an annual audit to ensure proper financial management and transparency in operations. The audit ensures compliance with relevant laws and regulations and provides assurance to members regarding the financial health of the society.

Producer Cooperative Society:

- Audit Requirement: Similar to Consumer Cooperative Societies, Producer Cooperative Societies are usually required to undergo an annual audit. The audit helps in verifying the production, sales, and financial transactions of the cooperative, ensuring accountability to its members.

Marketing Cooperative Society:

- Audit Requirement: Marketing Cooperative Societies often have a significant turnover of goods and finances. Therefore, they are mandated to conduct an annual audit to assess the efficiency of marketing operations, financial transactions, and compliance with regulations.

Housing Cooperative Society:

- Audit Requirement: Housing Cooperative Societies typically require an annual audit to review their financial statements, including maintenance fees, funds allocated for repairs and renovations, and compliance with legal requirements. The audit ensures transparency and accountability in managing the housing assets and finances.

Credit Cooperative Society:

- Audit Requirement: Credit Cooperative Societies, being financial institutions, have stringent audit requirements. They are usually subjected to regular audits by regulatory authorities as well as annual audits by external auditors. The audits focus on assessing the financial health, loan portfolio quality, and compliance with banking regulations.

Multi-Purpose Cooperative Society:

- Audit Requirement: Multi-Purpose Cooperative Societies combine various functions such as credit, marketing, and consumer services. They typically require an annual audit to ensure proper management of multiple activities, financial transparency, and compliance with legal requirements.

Farmers Cooperative Society:

- Audit Requirement: Farmers Cooperative Societies often require an annual audit to review agricultural activities, procurement of inputs, marketing of produce, and financial transactions. The audit helps in assessing the efficiency of agricultural operations and compliance with relevant regulations.

Service Cooperative Society:

- Audit Requirement: Service Cooperative Societies, which provide services such as healthcare, education, transportation, or utilities, may have varying audit requirements depending on the nature and scale of their operations. However, they usually undergo an annual audit to ensure proper financial management and compliance with regulations.

In summary, while the specific audit requirements may vary based on the type of Cooperative Society and applicable laws, most Cooperative Societies typically undergo an annual audit to ensure transparency, accountability, and compliance with legal and regulatory standards.

Society Audit Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: Society Audit Consultant | Society Audit Consolidated Package