PF Registration Consultant

Are you looking for Establishment PF Registration Consultant? Get Employer Provident Fund Registration Service at very reasonable charges across India. Every Establishment who is having more than 20 Employees are compulsory required Provident Fund Enrollment. Also, PF Code can be obtained voluntary basis. Our Provident Fund Expert will guide you EPF Rules, Contribution Rates, Process of Registration, Document Requirement for Registration and Compliance/Return filing brief. Contact us now for Employer PF Registration Consultancy.

Interested in PF Registration Service?

Establishment Provident Fund Code

Employer Provident Fund Registration is a crucial step mandated by The Employees’ Provident Fund and Miscellaneous Provisions Act of 1952 for establishments with 20 or more employees. This registration is essential to facilitate the systematic contribution towards the Provident Fund, a social security measure for the financial well-being of employees.

As an employer, once registered with EPF, it becomes obligatory to file a monthly return on or before 15th of succeeding month along with the payment of contributions. This filing process ensures compliance with regulations and contributes to the timely and accurate management of employee Provident Fund accounts.

The Provident Fund contribution comprises 12 percent from the employer and an additional 12 percent from the employee. Provident Fund is applicable to employees whose salary is less than Rs. 15,000.

For employers with less than 20 employees, there is an option to voluntarily register for Provident Fund. This voluntary scheme allows smaller establishments to participate in the benefits of the Provident Fund system, promoting financial security for their workforce.

Our Provident Fund Registration Consultancy streamlines the entire process through a comprehensive online platform. We pride ourselves on offering a swift and efficient service, ensuring the issuance of the Provident Fund Certificate within one hour. We work as PF Registration Consultant Across India, covering all major cities, making Provident Fund Registration hassle-free and accessible for employers nationwide.

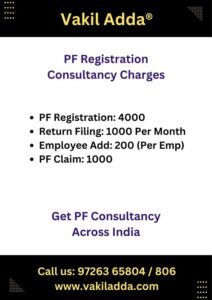

Provident Fund (PF) Consultancy Charges

We offer comprehensive PF consultancy services, including registration, return filing, and employee enrollment. Our consultancy charges are as follows:

- Employee PF Registration: Rs. 4,000

- PF Return Filing: Rs. 1,000 per month

- Employee Enrollment: Rs. 200 per employee (one-time expense)

- Employee PF Claim: Rs. 1,000 per claim

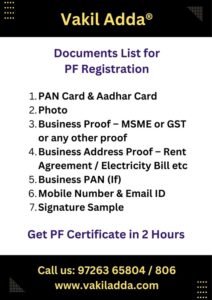

What are the Documents Required for Employer PF Registration?

Provident Fund Applicability for Establishments (Employers)

Provisions for Provident Fund Registration Apply to the Following Establishments/Companies:

- Companies or firms with a workforce of 20 or more employees must secure a PF Code.

- Factories involved in industries outlined in Schedule I of the Act.

- Other establishments as notified by the Central Government.

- Opting for Provident Fund Registration on a Voluntary Basis:

- Employers with fewer than 20 employees have the option to voluntarily register for PF.

- PF Registration tailored for tender-related requirements.

PF Deductions & Contributions Rules

Eligibility for the Provident Fund Scheme extends to employees earning a monthly salary of Rs. 15,000 or less. However, those with a higher income have the flexibility to voluntarily participate in the Provident Fund.

Contribution Rates:

- Employees contribute 12% of their salary, allocated to EPF.

- Employers contribute a total of 12% plus 1% of the salary, covering EPF, EPS, 0.5% EDLI, and 0.5% Admin Charge.

Although employees can contribute more than 12% of Rs. 15,000 at their discretion, employers are not obligated to match this additional contribution. Employers can contribute up to the ceiling limit of wages, i.e., Rs. 15,000.

Employees can opt-out of the Provident Fund on their joining day if the following conditions are met:

- They do not possess a previous PF Account Number (UAN) on the date of joining.

- Their salary exceeds Rs. 15,000.

Get Your PF Registration Code in 30 Mins - Process Now!

Our team will help you understand provident fund rules, document needs, and filing requirements.

Once you understand all parameter, you can send us document for Provident Fund Registration Application Filing.

After that, we will file PF Application via EPF Portal. Within 30 minutes, you will get PF Registration Certificate.

What are the requirements for compliance after PF registration?

After completing Provident Fund Registration, the following mandatory compliance and filing activities are required:

- Enroll employees on the PF portal during the joining process.

- Submit PF returns before the 15th day at the end of each month (Return filing due date is the 15th of every month).

- Make timely payments of both employee and employer contributions.

- Approve correction requests and modification queries submitted by employees as needed.

PF Registration Consultant Near You?

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: PF Registration Consultant | PF Registration Consolidated Package

Interested in PF Registration Consultancy - Download Quotation

FAQ's on Provident Fund Registration

Yes, Voluntary Registration can be obtained with any number of employees.

Yes, with the approval of the employee, any employer can implement PF. This will also facilitate tender filing.

Yes, we are PF Registration Consultant Serving across the nation, spanning Tier 1 and Tier 2 cities. Our 24×7 online support ensures constant availability. Our primary service hubs encompass vibrant locations such as Ahmedabad, Mumbai, Delhi, Bengaluru (Bangalore), Chennai, Kolkata, Hyderabad, Pune, Surat, Jaipur, Lucknow, Kochi, Indore, Visakhapatnam, and Coimbatore. Expanding beyond urban boundaries, we extend our services to states including Jammu and Kashmir, Himachal Pradesh, Punjab, Haryana, Uttarakhand, Rajasthan, Gujarat, Maharashtra, Madhya Pradesh, Chhattisgarh, Uttar Pradesh, Bihar, Jharkhand, West Bengal, Odisha, Sikkim, Assam, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Karnataka, Andhra Pradesh, Telangana, Tamil Nadu, and Kerala.