Tax Audit by CA

Are you looking for a tax audit by a Chartered Accountant (CA)? We provide Income Tax Audit Filing Services across India. We have a panel of Chartered Accountants who can make your tax auditing process smooth and hassle-free. If your business turnover is more than one crore, tax audit is compulsory. Additionally, if your business profit is below the specified limit for presumptive taxation, tax audit requirement arises. Here, you can explore the rules of Income Tax Audit, the applicability of audit, documents required for tax audit, the process, and audit fees. If you are in search of audit filing services from a Chartered Accountant, connect with us for your one-stop auditing solution.

Looking for Tax Auditor Near You?

Income Tax Audit

As per Section 44AB of The Income Tax Act, 1962, every taxpayer whose business turnover exceeds one crore (for professionals, the limit is fifty lakhs) in the financial year is required to undergo a tax audit under section 44AB. Additionally, if turnover is below one crore but net profit is below 8% (for banking channel turnover 6%), then tax audit is also required. Certain exemptions from tax audit are allowed subject to 95% of transactions of sales and expenses being from the banking channel; in such cases, tax audit is exempted until turnover reaches 10 crore.

A Chartered Accountant (CA) in practice can conduct the Income Tax Audit. A detailed audit shall be carried out by the CA, and an audit report in Form 3CA-3CD or 3CB-3CD is required to be submitted to the income tax portal along with the financial statements (Profit and Loss, Balance Sheet, etc.). With our presence across India, we have streamlined the tax audit procedure, making it very smooth. You just need to send us a certain list of documents as stated below, and we will provide tax audit services instantly. Furthermore, we assure you that audit filing will be completed on time as Due date for filing of Tax Audit report is 30th September.

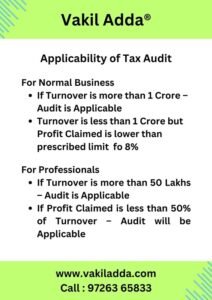

Applicability of Tax Audit (FY 2023-24, AY 2024-25)

Income Tax Applicability Depends on Turnover/Gross Receipts and Profit. In Following Situation Audit is Applicable.

For Normal Business

- If Turnover is more than 1 Crore – Audit is Applicable (If Turnover is less than 10 Crore and Cash Transaction of Sales and Expense is up to 5% of Turnover, Then Presumptive Taxation can be opt by tax payer and audit will be exempted)

- Turnover is less than 1 Crore but Profit Claimed is lower than prescribed limit of 8% (For Banking Transaction Turnover 6%) or Loss, Then Audit is required.

For Professionals

- If Turnover is more than 50 Lakhs – Audit is Applicable

- If Profit Claimed is less than 50% of Turnover – Audit will be Applicable

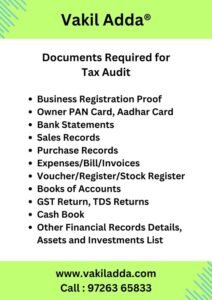

What Are the Documents Required for Income Tax Audit?

Following Documents required for Audit Procedure by CA

- Business Registration Proof, and Owner PAN Card, Aadhar Card

- Bank Statements

- Sales Records

- Purchase Records

- Expenses/Bill/Invoices

- Voucher/Register/Stock Register

- Books of Accounts

- GST Return, TDS Returns

- Cash Book

- Other Financial Records Details, Assets and Investments List

- Any Other Documents as and when ask by CA

Tax Audit - CA Fees

Chartered Accountant Fees for Income Tax Audit – Rs. 10,000/- (Starting, Depend on Volume of Transaction May Vary)

Income Tax Audit Consultancy Package

We provide comprehensive Income Tax Solution Including Income Tax Audit, Income Tax Return and Related Consultancy. Our Combo Includes

- Preparation of Books of Account (Will be prepared by Accountant Other than Auditor CA)

- Finalization of Accounts – Profit and Loss, Balance Sheet etc

- Filing of Audit Report by CA

- Income Tax Return Preparation and Filing

- Digital Signature

Thus, at one stop All the Income Tax Related Compliance can be obtained. Connect with us if you are interested in Income Tax Audit Combo Service.

Get Tax Audit Service from CA - File Tax Audit in 3 Days

If you are in requirement of Tax Audit, Make Inquiry and Send us relevant documents for Income Tax Audit Procedure.

Our Panel CA will Conduct Audit, CA will ask for necessary documents if required. On completion of Audit, CA will send draft copy of Audit report for review purpose.

CA Will Submit Income Tax Audit Report on Income Tax Portal. Same Physical Sign Copy with UDIN will be provided to you.

Important Information for Tax Audit

Important Points of Tax Audit

- Accounting Records are key element of Audit, For Audit Procedure Double Entry Book Keeping/Accounting is prima facie requirement.

- Due Date for Filing of Audit Report is 30th September.

- Chartered Accountant Must Generate Unique Document Identification Number (UDIN) for each tax audit report.

- Digital Signature of Company Representative (Owner) required for Acceptance of Audit Report.

Tax Audit Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: Tax Audit Consultant | Tax Audit Consolidated Pacakge Package

Frequently Asked Questions on Tax Audit by CA

A tax audit conducted by a Chartered Accountant (CA) is an examination of a taxpayer’s financial records to ensure compliance with the provisions of the Income Tax Act, 1961. It involves thorough scrutiny of financial statements and other relevant documents to verify the accuracy of income, deductions, and compliance with tax laws.

Tax Audit Process generally takes 5-7 Days. However, In Urgent Cases It can be finished in 2 Working Days.

Yes, Our Panel CA is Available Across India for Your Tax Audit Procedure. We can provide you nearest CA based at your location.