PF ESIC Return Filing Consultant

Are you searching for PF ESIC Return Filing Consultant? We are India’s Best Labour Law Consultant Providing Provident Fund Return Filing and ESIC Return Filing Service. Explore here Provident Fund Return Filing Rules, Due Date for Filing of Return and Charges of Return Filing. Contact us for PF and ESIC Return Filing Consultancy.

Looking for PF-ESIC Consultant?

PF and ESIC Return

Provident Fund and Employee State Insurance Contribution required to deduct from the salary of employee. After that, Employer required to furnish return with payment of respective PF and ESIC Amount. Provident Funds are the assets/fund of employee any failure in remittance of such payment is punishable as per the Act. Both PF and ESIC Return and Payment shall be made on or before 15th Day from the end of month. PF and ESIC Return filing is essential part of payroll and employee related consultancy. If you are in search of PF and ESIC Return Filing Consultant, Connect with us for smooth filing of PF and ESIC compliances.

Benefits of Hiring Expert for PF and ESIC Filing

Advantages of Hiring Expert for PF and ESIC Compliance

- Error Free Return Filing

- Accurate Calculation of PF and ESIC Tax

- Expert Guidance on Formation of Salary Structure

- Nullifying penalty

- Timely Compliance

Due Dates of Return Filing

Provident Fund Return : 15th of each month

ESIC Return: 15th of each month

Obtain Service for PF and ESIC Filing

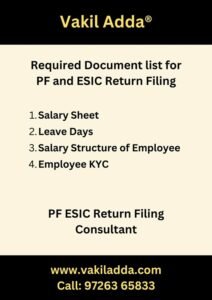

Send us documents for regular PF and ESIC Filing.

Based on document we will prepare Return. Review Return and Approve the same.

After your approval, we will file PF and ESIC Return.

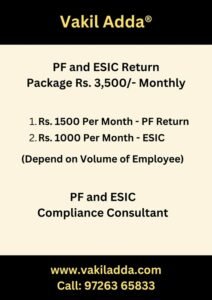

Our PF and ESIC Consultancy Package

In our Provident Fund & ESIC Filing Package, we offer the following services:

Calculation of Each Employee Contribution: Accurate calculation of employee contributions for Provident Fund (PF) and Employees’ State Insurance Corporation (ESIC) based on applicable rates and earnings.

Preparation and Filing of Monthly PF ESIC Statement: Compilation and preparation of monthly statements detailing PF and ESIC contributions for submission to the respective authorities.

Payment of Monthly PF ESIC Returns: Facilitation of timely and accurate payment of monthly PF and ESIC returns to ensure compliance with regulatory requirements.

Registration of New Employee in PF ESIC Portal: Assistance with the registration process for new employees on the PF and ESIC portals, ensuring seamless integration into the payroll system.

Calculation of Employer Contribution and C2C: Calculation of employer contributions towards PF and ESIC, including contributions towards C2C (Cost to Company) for accurate financial planning and reporting.

General Consultancy on PF and ESIC: Provision of expert consultancy services on various aspects of PF and ESIC compliance, including regulatory updates, employee queries, and best practices.

PF and ESIC Filing Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: PF ESIC Filing Consultant | PF ESIC Filing Consolidated Package

Frequently Asked Questions on PF and ESIC Return

Basically, Aadhar Card, PAN Card, Mobile Number, Email id and Bank Details are required to enroll such employee in PF and ESIC Portal.