Payroll Consultant in India

Are you looking for a Payroll Consultant in India? We are the best Payroll Consultant offering services related to employee and labor law consultancy. Our legal team and labor law experts will assist you in establishing a systematic approach to salary structure decisions, PF and ESIC compliance, employee taxation, payslip generation, wage slips, Form 16 issuance, and decisions regarding employee benefits schemes. Consult with our Payroll Expert now, who will guide you through all the compliance requirements applicable to labor laws in India.

Looking for Payroll Consultant in India?

Payroll Consultant

The role of payroll and payroll consultant in India is paramount for businesses of all sizes, ensuring accurate and timely compensation to employees while also maintaining compliance with labor laws and regulations. Payroll services encompass a wide range of functions, and payroll consultants play a crucial role in providing expertise and guidance in this domain.

Salary Processing: Payroll services involve the accurate calculation and processing of employee salaries, including basic pay, allowances, deductions, and bonuses. Payroll consultants ensure that salary computations are error-free and comply with statutory requirements.

Compliance Management: Payroll consultants are responsible for ensuring compliance with various labor laws, tax regulations, and statutory requirements related to payroll processing. They stay updated with the latest changes in legislation and ensure that payroll practices align with legal obligations.

Taxation and Deductions: Payroll consultants handle tax deductions such as Income Tax, Provident Fund (PF), Employee State Insurance (ESI), Professional Tax, and other statutory deductions. They ensure accurate tax calculations and timely deposit of taxes to the respective authorities.

Statutory Filings and Reporting: Payroll services include preparing and filing various statutory returns and reports, such as PF returns, ESI returns, TDS statements, and Form 16 issuance. Payroll consultants ensure that these filings are accurate and submitted within the prescribed deadlines.

Employee Records Management: Payroll consultants maintain comprehensive employee records, including personal details, salary information, tax declarations, and attendance records. They ensure confidentiality and data security while managing employee information.

Employee Benefits Administration: Payroll services often include managing employee benefits such as provident fund, gratuity, leave encashment, and insurance schemes. Payroll consultants assist in designing, implementing, and administering these benefits programs.

Payroll Audits and Reviews: Payroll consultants conduct regular audits and reviews of payroll processes to identify errors, discrepancies, or areas for improvement. They provide recommendations for enhancing efficiency, reducing costs, and ensuring compliance with best practices.

Advisory Services: Payroll consultants offer advisory services to businesses on various payroll-related matters, including structuring salary packages, designing compensation policies, resolving payroll-related disputes, and interpreting labor laws.

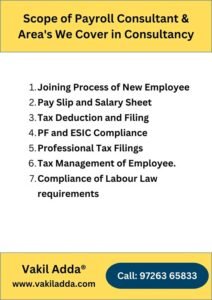

Scope of Payroll Consultant - Area's We Cover in Consultancy

Our Main Role as Payroll Consultant in India is to develop SOP for

- Joining Process of New Employee – Which Covers Documents to be obtained, Salary Structure Decision, and Contract.

- Pay Slip and Salary Sheet – Processing Salary via Pay Slip, Deduction Calculation etc

- Tax Deduction and Filing – Income Tax Deduction and Filing of TDS Return, Issuance of Form 16.

- PF and ESIC Compliance – Deduction of PF and ESIC and Filing of Return.

- Professional Tax Filings

- Tax Management of Employee.

- Compliance of Labour Law requirements

Benefits of Hiring Payroll Consultant

Engaging a payroll consultant offers unique advantages for businesses:

Compliance Confidence: Experts in ever-changing regulations, consultants ensure compliance, reducing legal risks and penalties.

Cost-Effective Solutions: Outsourcing saves expenses on salaries, training, and infrastructure, optimizing financial resources.

Core Focus: By handling payroll complexities, consultants free up time for businesses to focus on growth and innovation.

Tailored Support: Consultants provide personalized solutions, addressing specific needs with precision and efficiency.

Risk Reduction: Rigorous quality control minimizes errors, mitigating potential legal disputes and reputation damage.

Adaptability: Scalable solutions accommodate business growth, ensuring flexibility and efficiency as needs evolve.

Data Security: Confidentiality measures protect sensitive information, ensuring compliance with data protection regulations.

Strategic Insights: Consultants offer strategic guidance, leveraging industry expertise to optimize processes and drive success.

Employees Law & Labour Law Applicable in India

Below is list of Important Act(s) Applicable in India in relation to employment

The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 (EPF Act): Governs the establishment of provident funds, pension schemes, and deposit-linked insurance schemes for employees.

The Employees’ State Insurance Act, 1948 (ESI Act): Provides social security benefits such as medical, sickness, maternity, and disability benefits to employees.

The Payment of Bonus Act, 1965: Mandates the payment of bonuses to eligible employees based on profits earned by the organization.

The Payment of Gratuity Act, 1972: Provides for the payment of gratuity to employees upon termination of employment after completing a specified period of service.

The Minimum Wages Act, 1948: Prescribes minimum wage rates for different categories of workers in various industries and sectors.

The Maternity Benefit Act, 1961: Provides maternity benefits such as paid leave, medical allowances, and nursing breaks to women employees.

The Child Labour (Prohibition and Regulation) Act, 1986: Prohibits the employment of children in certain hazardous occupations and regulates their working conditions in non-hazardous occupations.

One Stop Payroll Management

Vakil Adda offers a comprehensive solution for all your employee law needs. As your one-stop destination, we provide expert guidance and assistance in navigating the complex landscape of employment laws in India. From ensuring compliance with labor regulations to resolving disputes and optimizing HR practices, our team of legal professionals is dedicated to safeguarding your organization’s interests while prioritizing the well-being of your workforce. With Vakil Adda – a premier Payroll Consultant in India, you can trust that your employee law concerns are addressed with precision, efficiency, and a deep commitment to excellence.

Process of Monthly Payroll and Compliance

We will Make SOP of Systematic Approach for Payroll Processing.

Your Team will provide us regular details as per SOP.

We will Process for Payroll, PF-ESIC Filing, Tax Filing Etc.

We are also serving for Global Clients

Our Payroll Consultancy is not only in India, We are currently serving for our global clients located in countries like Canada, USA, England (UK), Dubai, Australia etc. Also, We provide complete labour law solution of Multi National Company offices located in India.

Payroll Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: Payroll Consultant | Payroll Consultant Consolidated Package

FAQ's on Payroll in India

Yes, We can take care of all the provision of all Labour and employment Act Applicable in India for your Staff located in India.