Income Tax 80G Registration

Are you Searching for 80G Registration Consultant? Are you Searching for 80G Registration Consultant? Vakil Adda offers comprehensive consultancy services for 80G registration, assisting non-governmental organizations (NGOs) in obtaining tax exemptions for donors. Their expert Chartered Accountants guide organizations through the rules, requirements, documentation, and compliance processes necessary for 80G certification. This certification enables donors to claim deductions on their contributions, encouraging philanthropy. For more information or to consult with us experts, you can contact us.

Looking For 80G Registration Consultant!

Understanding the 80G Act: Tax Savings Through Charitable Donations

The 80G Act is a part of India’s tax laws that encourages people to donate to charities, NGOs, and other non-profit organizations by giving them a tax benefit. When you donate to an organization registered under 80G, you can claim a deduction on your taxable income, which means you pay less tax. Depending on the organization, you can get a 50% or 100% deduction on the amount you donate.

For example, if you donate ₹10,000 to an 80G-registered NGO, you can reduce your taxable income by ₹5,000 or ₹10,000, depending on the NGO’s category. This makes donating more attractive because it helps both the donor (by saving tax) and the organization (by receiving funds for their social work). To get 80G registration, an organization must be a registered trust, society, or Section 8 company and work for charitable causes like education, health, or helping the poor. Once registered, the organization can give donors a receipt that allows them to claim the tax deduction.

In simple terms, the 80G Act is a win-win: it helps donors save on taxes while supporting NGOs and charities to do good work for society.

Eligibility Criteria for 80G Registration

To get 80G registration, an organization must meet these conditions:

- Non-Profit Organization – Must be a Trust, Society, or Section 8 Company.

- Charitable Purpose – Should work for education, healthcare, poverty relief, or other social causes.

- No Profit Distribution – Funds should be used only for charitable activities.

- Proper Financial Records – Must maintain audited financial statements.

- No Religious or Political Links – Should not engage in political or religious activities.

- Legal Registration – Must be registered under the Trusts Act, Societies Act, or Companies Act.

- PAN Card – Should have a valid PAN issued by the Income Tax Department.

- Tax Compliance – Must file income tax returns regularly.

Meeting these criteria helps an NGO attract more donations while allowing donors to claim tax benefits.

Step-by-Step Guide to 80G Registration

Submit the 80G application to the Commissioner of Income Tax (Exemption) in your area.

After applying, the Income Tax Department reviews the documents and may visit your NGO’s office for a physical inspection.

If officials need more details, they may ask for extra documents. Make sure to provide them quickly.

Once everything is verified, the Commissioner grants the 80G certificate, allowing your NGO to offer tax benefits to donors.

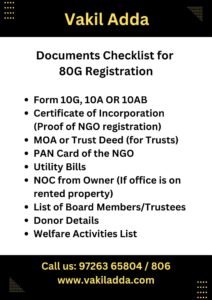

Document Checklist for 80G Registration

- Form 10G, 10A OR 10AB (Application form)

- Certificate of Incorporation (Proof of NGO registration)

- MOA (for Societies/Section 8 Companies) or Trust Deed (for Trusts)

- PAN Card of the NGO

- Utility Bills (Water, electricity, or house tax receipts)

- NOC from Owner (If office is on rented property)

- List of Board Members/Trustees

- Donor Details (Names, addresses, PANs)

- Welfare Activities List (Proof of NGO’s social work)

How Much Does 80G Registration Cost?

Our consultancy fee: ₹30,000 (covers guidance, document preparation, filing & follow-ups).

80G Registration Validity & Renewal: How to Keep Your Tax Benefits Active

Validity of 80G Registration

- When an NGO applies for 80G registration, it initially gets a provisional registration for three years.

- Before the three-year period ends, the NGO must apply for renewal to continue offering tax benefits to donors.

Renewal Process & Validity

- After the first renewal, the 80G certificate is valid for five years.

- Every five years, the NGO must reapply for renewal to maintain its 80G status and keep benefiting donors.

Key Points to Remember

- Provisional Registration: Valid for 3 years.

- Post-Renewal Validity: 5 years after the first renewal.

- Ongoing Renewal: Required every 5 years to stay compliant.

Conclusion

To continue enjoying tax-exempt donations, NGOs must track renewal deadlines and reapply on time. Missing renewal can lead to the loss of 80G benefits, impacting both the NGO and its donors.

Recent Changes in 80G Registration Norms You Should Know

Recent Changes in 80G Registration Norms You Should Know

The government has introduced significant changes in 80G registration norms to enhance transparency and ensure proper compliance by NGOs. One of the key updates is the mandatory renewal requirement—earlier, 80G registration was granted permanently, but now, NGOs must renew it every five years to continue offering tax benefits to donors. Additionally, provisional registration is now valid for only three years, after which a fresh application for renewal is required. The application process has also been streamlined with mandatory online filing via Form 10A or 10AB, making the process more structured and accountable. NGOs are now required to maintain detailed financial records, audited statements, and donor disclosures, ensuring greater transparency in fund utilization. These changes aim to prevent misuse of tax exemptions and ensure that only genuine charitable organizations benefit from 80G certification. NGOs must stay updated with these revised norms to avoid compliance issues and continue enjoying tax benefits for their donors.

Trusted 80G Registration Services Near You

Vakil Adda offers trusted 80G registration services, ensuring a hassle-free process for NGOs, trusts, and Section 8 companies. Get expert guidance, document preparation, and smooth approval for your 80G certification today!

For trusted 80G registration services, contact Vakil Adda

Call us at: 97263 65833

Visit our website: www.vakiladda.com

Get expert assistance for a smooth and hassle-free 80G certification process!