How NSIC Can Help You in Government Tender Procurement?

Welcome to Our Blog: How NSIC Can Help You in Government Tender Procurement? If you run a small or medium business and want to grow through government projects, you’re in the right place. Government tenders can bring huge opportunities, but the process is often confusing and competitive. Many businesses struggle with understanding the rules, preparing the right documents, and meeting all eligibility requirements.

This is where NSIC (National Small Industries Corporation) steps in to help. NSIC makes it simple for small businesses to participate in government tenders. They provide guidance on how to apply, keep you informed about new tender opportunities, and offer financial support like loans or performance guarantees. With NSIC’s assistance, your business can increase its chances of winning contracts, reach more customers, and build trust and credibility in the market.

Grow Your Business with NSIC Registration Act

The NSIC Registration Act is designed to support and empower Micro, Small, and Medium Enterprises (MSMEs) by helping them access bigger opportunities in government tenders and contracts. Many small businesses face challenges like high deposits, strict eligibility criteria, and lack of recognition while competing with larger companies. With NSIC registration, these barriers are reduced as MSMEs get exemption from Earnest Money Deposit (EMD), easier access to credit, and recognition as a trusted supplier for government projects. This makes it simpler for small businesses to participate in tenders and expand their business network.

In addition to financial relief, NSIC registration offers multiple benefits such as priority in government purchases, concessional security deposits, marketing assistance, and technical support. It also helps MSMEs build credibility and gain trust from buyers by showing compliance with government norms. For entrepreneurs and small business owners, the NSIC Registration Act acts as a bridge to growth, ensuring fair chances in the competitive market. If you want to grow your business, win tenders, and enjoy financial support, registering under NSIC can be one of the smartest steps you take.

Role of NSIC in Supporting MSMEs in Government Tenders

NSIC (National Small Industries Corporation) is a government organization that helps micro, small, and medium enterprises (MSMEs) grow in India. Its main role is to make it easier for small businesses to take part in government tenders and compete with bigger companies. By giving financial help and reducing paperwork, NSIC allows MSMEs to focus on getting more business opportunities.

Here’s how NSIC supports MSMEs:

Financial Help

Provides loans, credit facilities, and performance guarantees so that money is not a barrier in tender participation.Tender & Market Support

Shares tender information, helps with marketing, and connects MSMEs with government buyers.Technical Guidance

Guides businesses to meet quality standards and tender requirements.Registration Benefits

Through the Single Point Registration Scheme (SPRS), MSMEs get benefits like exemption from earnest money deposits (EMD).Training & Skill Development

Organizes programs to improve knowledge and confidence for handling tenders.Step-by-Step Support

Helps first-time participants understand the tender process easily.Global Opportunities

Supports participation in trade fairs and exhibitions to reach international buyers.

With these services, NSIC makes government tendering simple, supportive, and beneficial for small businesses.

Why NSIC is Important for Small Businesses

Small businesses often struggle to compete with larger companies in government tenders due to limited resources, strict requirements, and lack of market visibility. NSIC registration helps overcome these challenges and creates fair opportunities for MSMEs to grow.

Here’s why NSIC is important for small businesses:

Reserved Opportunities – Makes businesses eligible for government contracts that are specially reserved for MSMEs.

Financial Relief – Offers exemptions from certain financial requirements like Earnest Money Deposit (EMD) and provides easier access to loans or working capital.

Builds Credibility – Improves trust and confidence in the eyes of government buyers and big clients.

Performance Support – Provides performance and credit guarantees so businesses can take on bigger projects without financial stress.

Market Visibility – Ensures MSMEs are listed in government procurement databases, giving them better chances of being selected.

Tender Information Updates – Keeps businesses informed about upcoming tenders so they never miss an opportunity.

Guidance & Training – Helps entrepreneurs understand the tendering process and prepares them to compete effectively.

Global Exposure – Gives opportunities to showcase products in national and international trade fairs, boosting brand recognition.

With NSIC registration, small businesses not only save money and time but also gain the confidence to compete with bigger players in the market.

Key Benefits of NSIC in Government Tender Participation

Getting registered with NSIC gives small businesses many advantages when applying for government tenders. It makes the process easier, saves money, and increases the chances of winning contracts.

No EMD Required – You don’t need to pay heavy Earnest Money Deposits to take part in tenders.

Priority in Government Buying – MSMEs get preference in government purchases, which improves chances of getting contracts.

Easy Finance Support – NSIC helps with working capital loans, credit support, and performance guarantees.

Guidance & Training – Helps small businesses understand tender rules, improve product quality, and meet requirements.

Simple Process – NSIC guides you step by step, making tender applications less complicated.

Better Visibility – Registered MSMEs are listed in official databases, so buyers can easily find and trust them.

Cost Saving – Reduces extra expenses by offering exemptions and subsidies in exhibitions.

Bigger Opportunities – Supports MSMEs to take part in trade fairs and explore international markets.

With these benefits, NSIC makes government tendering simple and supportive for small businesses, helping them grow faster.

Challenges Faced Without NSIC Registration

Hard to qualify for tender eligibility.

Need to pay high Earnest Money Deposit (EMD).

Miss out on contracts reserved only for MSMEs.

No guidance on tender rules, paperwork, or process.

Less trust and credibility with government buyers.

No financial support like loans, credit, or guarantees.

Lower visibility as business is not listed in NSIC database.

More competition with bigger companies without any special support.

Higher cost of participating in tenders.

Limited knowledge about upcoming government tenders.

Difficulty in meeting technical and quality requirements.

No help for first-time tender participants.

Fewer chances to showcase products in trade fairs and exhibitions.

Documents Required for NSIC Registration

To apply for NSIC registration, a business needs to submit some basic documents. These help in verifying identity, financial stability, and business details. The main documents include:

PAN Card of the business or owner.

UDYAM Registration Certificate as proof of MSME status.

Details of Plant & Machinery used in the business.

List of Quality Control Equipment available in the unit.

Financial Statements & ITRs of the last three years.

Audit Report certified by a Chartered Accountant.

Bank Report in the format given by NSIC.

Required Declarations as per NSIC guidelines.

For Partnership, LLP, or Company: Corporate Identification Number (CIN), Partnership Deed, Memorandum of Association (MoA), and Articles of Association (AoA), whichever is applicable.

NSIC Registration Charges and Fee Structure

We provide NSIC Registration services at just ₹10,000 (our consultancy fee). Please note, the official NSIC government fees are charged separately as per the business turnover:

For turnover up to ₹1 Crore

Micro Enterprise: ₹3,000

Small Enterprise: ₹5,000

For turnover above ₹1 Crore (per additional crore)

Micro Enterprise: ₹1,500 per crore

Small Enterprise: ₹2,000 per crore

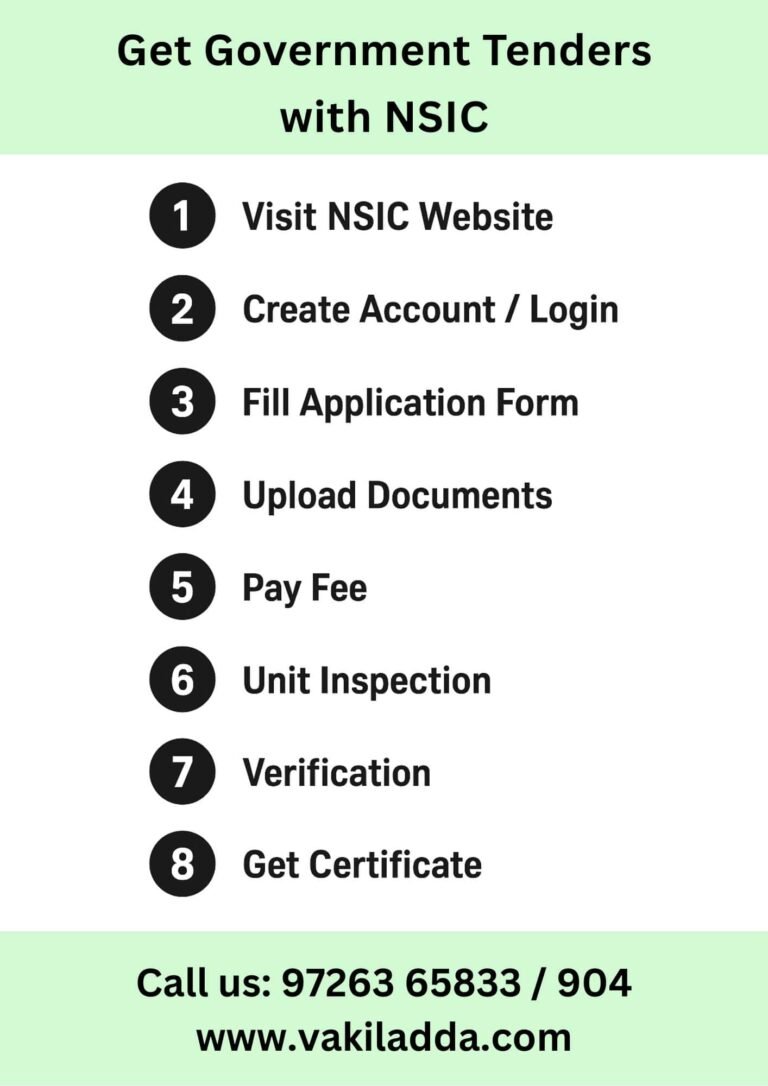

Step-by-Step NSIC Registration Process (Online)

Getting NSIC registration online is simple if you follow the steps carefully. Here’s how the process works:

Step 1: Visit the NSIC Website

Go to the official NSIC portal and click on the option for “Apply for Registration.”

Step 2: Create an Account / Login

If you are a new user, create an account by filling in basic details. If you already have an account, simply log in.

Step 3: Fill Out the Application Form

Enter all business details such as company name, UDYAM Registration Number, business address, turnover, and contact information.

Step 4: Upload Required Documents

Upload the necessary documents like PAN, UDYAM Certificate, financial statements, bank report, list of machinery, and other applicable papers.

Step 5: Pay the Registration Fee

Make the payment online as per your business category (Micro or Small Enterprise) and turnover.

Step 6: Unit Inspection by NSIC

After submission, NSIC will schedule an inspection of your business unit to verify the details and documents.

Step 7: Verification & Approval

The NSIC team will review your application, inspection report, and documents.

Step 8: Get Your NSIC Certificate

Once approved, your NSIC Registration Certificate will be issued, and you can download it from the portal.

Eligibility Criteria for NSIC Registration

Not every business can apply for NSIC registration. To qualify, your business needs to meet certain requirements set by the government. Here are the main conditions in simple words:

✅ Be an MSME – Your business should fall under the category of Micro, Small, or Medium Enterprise as defined by the government.

✅ Valid Registrations – You must have a PAN card and GST registration in the name of your business.

✅ Legally Registered Business – Your business should have proper licenses, approvals, or incorporation documents (like UDYAM certificate, Partnership Deed, or Company Incorporation Certificate).

✅ Operational Unit – The business must be running and have a functional office, plant, or workshop.

✅ Capacity to Deliver – Your unit should be capable of producing goods or providing services as per government tender requirements.

✅ Financial Stability – You should have proper financial records, including ITRs and audited statements, to show that your business is genuine and financially healthy.

✅ No Major Defaults – Businesses blacklisted or with major loan defaults may not qualify.

✅ Experience or Capability – Either some prior experience in supplying goods/services or the capacity to meet demand if awarded a tender.

Exemption from Earnest Money Deposit (EMD) and Other Financial Benefits

No need to pay Earnest Money Deposit (EMD) in government tenders.

Concessions in performance security deposits.

Easy access to working capital and credit facilities.

Priority in government procurement schemes.

Cost savings through exemptions and concessions.

Better cash flow with bill discounting and credit support.

Easier access to finance for large projects.

Reduced financial burden helps MSMEs grow faster.

Your Trusted Consultant for NSIC and Government Tender Support

Navigating NSIC registration and government tender procedures can be confusing for many businesses. At Tender Adda, we make the entire process smooth, simple, and affordable. Our goal is to help MSMEs not only get registered with NSIC but also successfully participate in government tenders with full confidence.

Our Key Services at Tender Adda

- NSIC Registration Support – End-to-end assistance with documentation, application filing, and approvals.

- Government E-Tender Registration – Get registered on official tender portals without hassle.

- Tender Alerts & Updates – Regular notifications of live tenders relevant to your business.

- Bidding Assistance – Guidance in preparing and submitting winning tender bids.

- Financial Benefits – Support in availing EMD exemptions, credit facilities, and performance guarantees.

- First-Time Guidance—Step-by-step support for businesses new to government tenders.

- Ongoing Consultancy – Continuous updates and expert advice to keep you ahead in tender opportunities.

At Tender Adda, we go beyond registration. We help you identify the right tenders, prepare competitive bids, and grow your business through government contracts.

📞 Contact Us Today: +91 97263 65833

🌐 Visit: www.vakiladda.com