GST Return Filing Consultant

Are you looking for a GST Return Filing Consultant? We are India’s premier Goods and Services Tax (GST) Return Filing Consultant, providing services across the nation. After registration with the GST Department, return submission is compulsory, which mainly includes GSTR-3B, GSTR-1, and GSTR-9 filings. Connect with us for your GST compliance needs and ensure timely completion of your GST filing.

Looking for GST Return Filing Consultant?

GST Return Filing

Goods and Services Tax (GST) Returns serve as a summary of sales and purchases. In this summary, the taxpayer reports the total output GST on sales and the total input GST on purchases. Furthermore, taxpayers are required to settle the difference between output GST and input GST via the GSTR-3B Return. Sales bills/invoices must be uploaded to the GST Portal through the GSTR-1 Return. Goods and Services Tax Returns are mandatory, even if there is no turnover or business activity.

The GST Compliance System does not offer the option to revise returns, so utmost care must be taken when filing. Additionally, the GST return filing process can be complex for taxpayers with multiple rate billing and multiple HSN/SAC Code billing. Furthermore, nil tax-rated, exempted supplies, and interstate purchases and sales further complicate the filing process. It is advisable to rely on experienced Chartered Accountants and qualified GST consultants for GST return filing. At Vakil Adda, we have a team of GST experts capable of handling complex GST filings, whether you are a regular taxpayer or a composition GST taxpayer.

Compliance for GST includes monthly filings of regular returns and annual filings. However, in some cases where turnover exceeds 2 Crore, GSTR-9 is required, and if turnover exceeds 5 Crore, GSTR-9C is required.

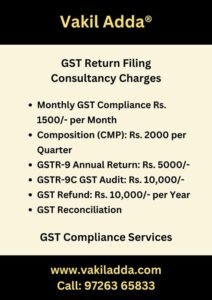

GST Return Filing Consultancy Charges

We provide comprehensive GST Return Filing and Compliance Services. Our Charges for Filings are as

- Monthly GST Compliance: Rs. 1500/- Per Month Starting (GSTR-1 and GSTR-3B)

- Composition (CMP): Rs. 2000 Per Quarter

- GSTR-9 Annual Return: Rs. 5000/-

- GSTR-9C GST Audit: Rs. 10,000/-

- GST Refund: Rs. 10,000/- Per Year

- GST Reconciliation: Depend on Volume

Types of GST Return and Compliance Due Date

- Monthly GST Compliance

- GSTR-1: Sales Return

- GSTR-3B: Outward and Inward Supply Summary & Tax Payment

- Quarterly GST for Composition Tax Payer

- CMP-8: Summary of Sales and Tax Payment

- Annual Return

- GSTR-9: Annual Return

- GSTR-9C: Account Reconciliation – Audit

- Other (Special Category Tax Payer)

- GST TDS

- GST TCS

- Input Distributors

- GSTR 5/5A

Due Dates of Return

- GSTR-1: 11th of Every Month

- GSTR-3B: 20th of Every Month (For Smooth Compliance Some State have 22th and 24th as due date)

- Small Tax Payer can opt for Quarterly Filing of GSTR-1

- GSTR9 and 9C: 31st December of Every Year

Advantages of GST Return Filing by GST Expert

Utilizing a GST expert for GST compliance can offer numerous benefits, including:

- Maintaining accurate filing records.

- Minimizing errors in returns.

- Providing suggestions for improving accounting and tax systems.

- Facilitating penalty and tax savings.

- Offering expert guidance on complex matters.

- Preventing GST demand notices.

- Enhancing governance and ensuring transparent tax filings.

Obtain GST Return Filing Service

Connect with our GST Expert, We will analyze your business activity. After that, we will send check list of documents and details you need to send us on monthly basis.

By end of each month, you need to send us documents and details as per Checklist Provided by us.

Our GST Expert and CA will prepare Return and Complete Filing. We assure that your all GST Compliance completes in time.

GST Demand Notice & Scrutiny

Improper Filing and Non Filing of GST Return may cause penalty.

Penalty of Late Filing of GST Return

- Rs. 50 Per Day Per Return

- Rs. 20 Per Day Per Return (if Nil Filing)

GST Return Filing Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: GST Return Filing Consultant | GST Return Filing Consolidated Package

Frequently Asked Questions on GST Return Filing

Yes, GST Return filing is mandatory even for nil business transactions. However, you can opt for quarterly filing as suitable options.

Absolutely! We specialize in ensuring hassle-free GST return filing services nationwide, covering all major Tier 1 and Tier 2 cities. Our dedicated 24/7 online support is always at your service. Our service areas include key cities such as Ahmedabad, Mumbai, Delhi, Bengaluru (Bangalore), Chennai, Kolkata, Hyderabad, Pune, Surat, Jaipur, Lucknow, Kochi, Indore, Visakhapatnam, and Coimbatore. Moreover, we cater to regions spanning from Jammu and Kashmir to Kerala, ensuring comprehensive coverage for all your GST return filing needs.