Future & Options Trader ITR and Audit

Are you looking for Future & Options Trader ITR and Audit? We specialize in Future and Options (F&O Derivatives) Tax Consultancy Services, including accounting, audit, and income tax return filings. There is a specific mechanism for future and options accounting and auditing, and the audit requirement criteria method are also unique. Want to know whether you, as an F&O Trader, require Income Tax Audit u/s 44AB or not? Connect with Our Chartered Accountant (CA). Explore here the rules of F&O Tax Filing, audit requirements, documents required for audit, process of F&O audit, ITR filing, and charges for audit for Derivatives trading business.

Required CA for F&O Transaction Audit & ITR Filing?

Derivative Taxation & Audit Rules

Futures and Options (F&O) activities in the stock market involve hedging trades and positions. Generally, traders engage in futures and options (derivatives) for hedging, speculation, short-term gains, arbitrage trades, etc. According to the Income Tax Act, F&O trading/activities are considered non-speculative transactions under Section 43(5) of the Income Tax Act, 1961. Any transactions related to shares (commodities, stocks, scripts, stock exchange instruments, etc.) squared off without taking delivery (without being credited or debited in DEMAT) are treated as speculative transactions except for derivatives. Therefore, trading in stocks/shares (same-day purchase and sale) is considered speculative, while derivatives (futures and options) trading, whether in shares, commodities, or currency derivatives, is considered non-speculative. Thus, trading in futures and options is regarded as a normal business activity, and taxation rules for normal businesses apply.

Derivatives transactions are mainly available in three segments in India: stocks (shares), commodities, and currency markets. Despite considering F&O transactions as normal business activities, the taxation aspect is more complex compared to normal businesses. Calculating turnover in futures and options transactions is unique. For futures transactions, turnover is the cumulative result of trades, ignoring positive and negative signs, whereas for options transactions, the premium amount is turnover.

Income tax return filing is mandatory for futures and options traders. However, the requirement for income tax audit depends on the turnover of the F&O business. Tax audit is necessary if the turnover of the F&O business exceeds one crore (not opting for presumptive taxation, i.e., profit is less than 6%), or in cases of loss or claimed profit being less than 6% or 8%. If you need an income tax filing consultant for F&O activities or require a Chartered Accountant (CA) for future and options tax audit, connect with us.

Applicability of Audit in Case of Futures & Options Trading

Tax audit is required for F&O transactions in the following situations:

- When the F&O turnover exceeds INR 10 Crore – Audit Required.

- When the F&O business turnover is between INR 2 Crore to INR 10 Crore, AND the declared loss or declared profit is less than 6% – Audit required if total income exceeds the basic exemption limit; otherwise, not required.

- If the transaction of F&O is up to INR 2 Crore and opting for presumptive taxation, then audit is not required. However, if not opting for presumptive taxation, audit is required.

How to Calculate Turnover in Derivative (F&O) Transactions

Calculation of Turnover for Future and Options transactions are unique and different. Each Transactions result whether favorable or unfavorable are considered as turnover. That means total of cumulative outcome of squared off position ignoring plus or negative sign. Let’s understand via example,

(Future) Trade No. 1: Futures Buying at Rs. 10,000 and Selling at Rs. 8000, Results in Loss of Rs. 2,000

(Options) Trade No. 2 Options Buying at Rs. 25000 and Selling at Rs. 26,000, Results in Profit of Rs. 1,000

In This Two Trades Total Turnover will be Rs. 3,000 and Profit & Loss Account will be (Loss Rs. 1000).

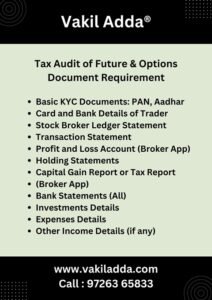

What Are the Documents Required for Tax Audit of F&O Transactions?

Following documents required for Future and Options (Derivatives) Transaction ITR Filing and Tax Audit.

- Basic KYC Documents: PAN, Aadhar Card and Bank Details of Trader

- Stock Broker Ledger Statement

- Transaction Statement

- Profit and Loss Account (Broker App)

- Holding Statements

- Capital Gain Report or Tax Report (Broker App)

- Bank Statements (Saving and Current All Accounts)

- Investments Details

- Expenses Details

- Other Income Details (if any)

Tax Benefit of F&O Loss for Eight Years

Any loss claimed during ITR filing by an F&O trader is allowed to be carried forward for eight years. Furthermore, it can be set off against any profits of the next years (up to eight years). Thus, carrying forward losses from future and options transactions is a crucial task that will help in saving for the future. If you have incurred loss in this year while doing Future and Options Trading, Connect with our Future & Options Trader ITR and Audit Expert for claiming carry forward of your F&O Loss.

CA F&O Tax Audit - Complete Online Process - Get in 3 Days

If you are an F&O Trader and required tax compliances, you just need to send us required documents. Our CA team will start working on it. First Finalization of Profit and Loss, Balance Sheet will be done.

After that, Chartered Accountant will conduct Audit, Same will be prepared by CA. We will share Audit and ITR Draft copy before submission.

On your confirmation, Our Team will file Audit Report and Income Tax Return to the respective Income Tax Authority. Further, We will CA Signed, Sealed and UDIN Copy of Audit Report to your door step delivery,

What are the Expenses can be claimed by F&O Trader while filing ITR?

Futures and Options (F&O) traders can claim various expenses while filing their Income Tax Returns (ITR). These include brokerage charges for executing trades, internet and communication expenses related to trading activities, fees for trading software and platform subscriptions, and a portion of office rent and utilities if a dedicated space is used for trading. Additionally, depreciation on equipment like computers and monitors used for trading purposes may be deductible. Traders can also deduct educational expenses for trading-related courses, bank charges, interest on trading-related loans, research expenses, professional fees, and a portion of travel expenses incurred for trading-related activities. Keeping detailed records of these expenses is essential for supporting claims during tax filing and consulting with a tax professional can provide personalized guidance on maximizing deductions and ensuring compliance with tax regulations.

F&O Audit Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: F&O Audit Consultant | F&O Audit Consolidated Package

Frequently Asked Questions on F&O Tax Audit

Yes, Digital Signature is mandatory for future and options Audit Report Acceptance.

Yes, We provide complete online solution for future and options Tax Audit, Client presence is completely optional for our Audit service.

Yes, we provide Future and Options Income Tax Audit services across India, including major cities such as Mumbai, Delhi, Bengaluru, Chennai, Hyderabad, Pune, Kolkata, Ahmedabad, Jaipur, Lucknow, and others. Our experienced team ensures thorough compliance and accuracy in tax filings, offering tailored support regardless of your location. Feel free to reach out to us for reliable assistance with Future and Options Income Tax Audit in your city.