FFMC License Consultant

Are you in search of Full Fledge Money Changer – FFMC License Consultant? We provide comprehensive FFMC License Consultancy Service Across All States of India. Our Forex License Expert will provide you complete information of FFMC License Rules, Activities, RBI Circular, Qualification for License, Documents Requirement, Application Process and charges. Connect with us for your Full Fledge Money Changer (FFMC) License requirement.

Looking for FFMC License Consultant?

Full Fledge Money Changer License

In India, Reserve Bank of India (RBI) governs and regulate the foreign Currency exchange mechanism. As per Section 10(1) of FEMA Act, 1999 only FFMC License holder can entered in to business of foreign currency sale or purchase. FFMC License is short form of Full Fledge money changer License. Further, Full Fledge money changing business is highly regulated by reserve bank Thus, Only Authorized License holder can do Money/Forex Changing activity in India. Minimum requirement for application of FFMC License is company should be Private Limited or Public limited with Minimum 25 Lakhs Capital/Net Owned Funds.

Tourism, business visits, foreign travel, and students studying outside India all contribute to the demand for currency exchange services. Tourists exploring new destinations require local currency to facilitate their transactions and experiences. Similarly, individuals traveling abroad for business engagements often need to exchange currency to conduct transactions efficiently. Students studying overseas rely on currency exchange services to manage their expenses while pursuing their education in foreign countries.

However, obtaining an FFMC license in India can be a complex and Regulatory process. It requires lots of documentation, compliance with regulatory standards, and a thorough understanding of RBI guidelines for license issuance. This is where FFMC license consultants in India play a vital role. We as consultants specialize in FFMC License application process, ensuring that businesses meet all regulatory requirements and get license from RBI. Also, As FFMC License Consultant we are doing FFMC Business Routine Compliance and Renewal Service.

What activities can be carried out by an FFMC license holder?

A Full Fledged Money Changer (FFMC) possesses the authority to engage in a spectrum of currency transactions:

Procurement of foreign currency notes, coins, or traveler’s cheques is facilitated by FFMCs from both residents and non-residents of India.

FFMCs are empowered to provide foreign visitors and tourists with Indian Rupees (INR) in exchange for various forms of international payment, including debit cards, foreign currency, prepaid cards, and other prompt methods.

With their official designation, FFMCs are authorized to conduct foreign exchange transactions catering to a diverse range of purposes such as private visits, business visits, tourism, and more.

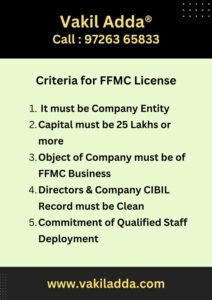

Criteria and Qualification for FFMC License Application

Full Fledge Money Changer License can be obtained after fulfillment of following criteria:

The applicant must be a registered company under the provisions of the Companies Act 2013, either as a Private Limited or Limited company.

The company’s Net Owned Fund (NOF) should amount to Rs. 25 Lakhs for obtaining a Single Branch license and Rs. 50 Lakhs for Multiple Branches license.

The Memorandum of Association (MoA) of the company must explicitly state the business activity of Full Fledged Money Changer (FFMC).

The FFMC company must maintain a clean CIBIL record, demonstrating financial integrity and reliability.

- Adequate and competent staff must be deployed by the FFMC company to effectively execute foreign currency exchange operations, ensuring smooth and efficient service delivery.

- Directors of the company must possess clean records, both in terms of Civil and Criminal history, ensuring trustworthiness and compliance with legal standards.

The FFMC is required to commence foreign currency exchange operations within 6 months from the date of license issuance to uphold regulatory obligations.

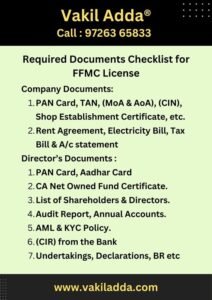

What are the Documents Required for FFMC License Application?

There are numerous documents required to prepare for a Full Fledged Money Changer License Application. Some of the highlights of the documents include:

- Company Documents: PAN Card, TAN, Memorandum of Association (MoA) and Articles of Association (AoA), Corporate Identification Number (CIN), Shop Establishment Certificate, etc.

- Address Proof: Rent Agreement, Electricity Bill, and Tax Bill.

- Directors’ PAN Card, Aadhar Card, and Bank Statement.

- Chartered Accountant’s Net Owned Fund Certificate.

- Company’s Bank Statement.

- List of Shareholders and Directors.

- Audit Report.

- Annual Accounts.

- Anti-Money Laundering (AML) Know Your Customer (KYC) Policy.

- Confidential Information Report (CIR) from the Bank (for Directors and Company).

- Undertakings (to be provided by us).

- Declarations (to be provided by us).

- Board Resolutions (to be provided by us).

FFMC License Consultant Fees & Charges

We provide comprehensive Full Fledge Money Changer License Solution, For that we charge as follows

- FFMC License Consultancy Charges: Rs. 90,000/-

- Company Registration: Rs. 10,000/- (Exclusive of Stamp Duty, Stamp Duty Depends on Capital of Company)

Process of FFMC License

Firstly, We need to prepare Documents for FFMC License Registration Application. Such Application will be submitted with complete documents list. Regional RBI Office will consider application for further process.

After that, RBI Regional office Forex Department will evaluate the FFMC License Application. If RBI Deems fit then they can call for Interview Process. Also, RBI can process without interview if they finds application in order.

Within 60 to 70 days FFMC License Application will be processed and License will be issued. License holder must file compliance and renewal on time.

Renewal of FFMC License

FFMC License will be valid for One Year. After that, Renewal application required to submit before 60 days of expiry of license. License holder must file all compliance, modification in license particular etc., Without proper compliance RBI will not consider renewal application.

Registers Essential for FFMCs to Maintain:

FFMCs are required to maintain several essential registers:

1. FLM-1: Daily Register of Foreign Currency Balance – records daily foreign currency holdings.

2. FLM-2: Daily Summary of Traveler’s Cheques – summarizes daily traveler’s cheques transactions.

3. FLM-3: Register of Purchased Foreign Currencies – logs all purchases of foreign currencies.

4. FLM-4: Register of Foreign Currency Purchases – details purchases from authorized dealers and money changers.

5. FLM-5: Book of Sale of Foreign Currency – documents the sale of foreign currency and traveler’s cheques.

6. FLM-6: Summary of Sale to Authorized Dealers/FFMC Banks – outlines sales to authorized entities.

7. FLM-7: Traveler’s Cheques Surrendered – records surrender to authorized entities or export.

8. FLM-8: Monthly Consolidated Statement – a monthly summary of all foreign currency transactions across FFMC offices, due by the 10th of the following month.

Franchise RMC in FFMC

Franchise Retail Money Changers (RMC) function as integral components within the Full Fledged Money Changer (FFMC) ecosystem, extending its services across diverse locations. Operating under the umbrella of established FFMC entities, RMCs serve as decentralized hubs, bringing foreign exchange facilities closer to communities. By partnering with FFMCs, these franchises benefit from their expertise, infrastructure, and regulatory compliance, ensuring the seamless provision of currency exchange services. RMCs play a pivotal role in catering to the needs of travelers, businesses, and individuals, offering convenient access to foreign exchange solutions in various regions. This collaborative model not only enhances the accessibility of FFMC services but also empowers local entrepreneurs to capitalize on the burgeoning demand for reliable and efficient currency exchange facilities.

Reserve Bank of India Regional Office for FFMC License Issuance

The Reserve Bank of India (RBI) operates through a network of regional offices strategically positioned across India to oversee and regulate banking and financial activities within their respective regions. These offices include Mumbai (Western Region), New Delhi (Northern Region), Kolkata (Eastern Region), Chennai, Bengaluru, and Hyderabad (Southern Region), Ahmedabad (Western Region), Jaipur, Lucknow, and Chandigarh (Northern Region), Thiruvananthapuram, Kochi, and Bhopal (Southern Region), and many more. Each regional office serves as a vital hub for supervising and implementing RBI policies, conducting inspections, and facilitating communication between the central bank and financial institutions within their jurisdiction. Through this decentralized structure, the RBI ensures effective regulatory oversight and enforcement across diverse geographical areas, contributing to the stability and integrity of India’s financial system. We are the only FFMC License Consultant who is working PAN India for Forex Business license.

FFMC License Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: FFMC License Consultant | FFMC License Consolidated Package

Frequently Asked Questions on FFMC License

- Applicant must be Company Form of Entity

- Director Must have clean civil and criminal record

- Net Owned Fund of Company must be more than 25 Lakhs for Single Branch (50 Lakhs for Multiple Branch)

Yes, If FFMC Fails to comply with provision of Act, RBI have complete authority for revocation of license.