Everything you Need to Know About Starting a Section 8 company

Welcome to our blog, where we share everything, you need to know about starting a Section 8 Company. A Section 8 Company is a non-profit organization in India that works for causes like education, charity, environmental protection, sports, and research. Unlike regular companies, it doesn’t share profits among its members but uses them to achieve its mission. To start one, the directors need to get Digital Signature Certificates (DSC) and Director Identification Numbers (DIN). After that, they must get the company name approved and submit important documents like the Memorandum of Association (MoA) and Articles of Association (AoA) to the Registrar of Companies (RoC). The company also needs government approval before it can be officially registered.

A Section 8 Company gets tax benefits, lower stamp duty, and fewer legal formalities compared to other companies. However, it must keep proper records, file annual returns, and use funds only for its intended purpose. If the company closes, its assets cannot be taken by members but must be given to another Section 8 Company. Even with strict rules, this structure is a trusted and legally recognized way for NGOs, trusts, and non-profits to operate effectively.

Get Expert Help for Section 8 Company Registration!

Professional Overview of Section 8 Company Formation & Compliance

A Section 8 Company is a non-profit organization registered under the Companies Act, 2013, created to promote social causes like education, charity, environmental protection, sports, and research. Unlike regular companies, it cannot share profits with its members. Instead, any income must be used to fulfil its mission. These companies receive tax benefits under Section 12A and 80G of the Income Tax Act, 1961, lower stamp duty, and fewer compliance requirements compared to other organizations.

To start a Section 8 Company, directors must first get Digital Signature Certificates (DSC) and Director Identification Numbers (DIN). Next, they must apply for name approval on the MCA portal and submit documents like the Memorandum of Association (MoA) and Articles of Association (AoA) to the Registrar of Companies (RoC). Approval from the Central Government under Section 8 of the Companies Act, 2013, is required before registration. Once registered, the company must follow legal rules like filing annual returns (Section 92), maintaining financial records (Section 128), and conducting board meetings (Section 173). If the company closes, as per Section 8(10), its assets must be given to another Section 8 Company or a government-approved entity.

Despite strict rules, Section 8 Companies are a popular choice for NGOs and non-profits due to their credibility, tax benefits, and legal recognition, making them a structured way to work for social causes

Legal Documents Required for Section 8 Company Formation

To simplify the registration process for your Section 8 Company in Rajkot, ensure you have the following documents ready:

- Identity proof of two directors (Aadhar Card, Voter ID, Passport, or Driving License)

- PAN Card for both directors/members

- Recent passport-sized photographs of the directors/members

- Bank account statement or passbook of directors/members for address verification

- Active mobile number and email ID for communication

- Office address proof with the latest utility bill (electricity or telephone bill)

Having these documents in place will help speed up the registration process and avoid unnecessary delays.

Financial Cost of Establishing a Section 8 Company

The registration cost for a Section 8 Company is approximately ₹15,000, covering legal formalities, government fees, and compliance requirements. This ensures smooth incorporation under the Companies Act, 2013.

Inclusions:

- Company Incorporation & Government Fees

- Drafting of MoA & AoA

- PAN & TAN Registration

- PF & ESIC Registration

- DIN & DSC for Directors

- Business Bank Account Setup

- INC-20A (Commencement Certificate)

- ADT-1 (Auditor Appointment)

This package ensures your Section 8 Company is fully compliant and legally structured.

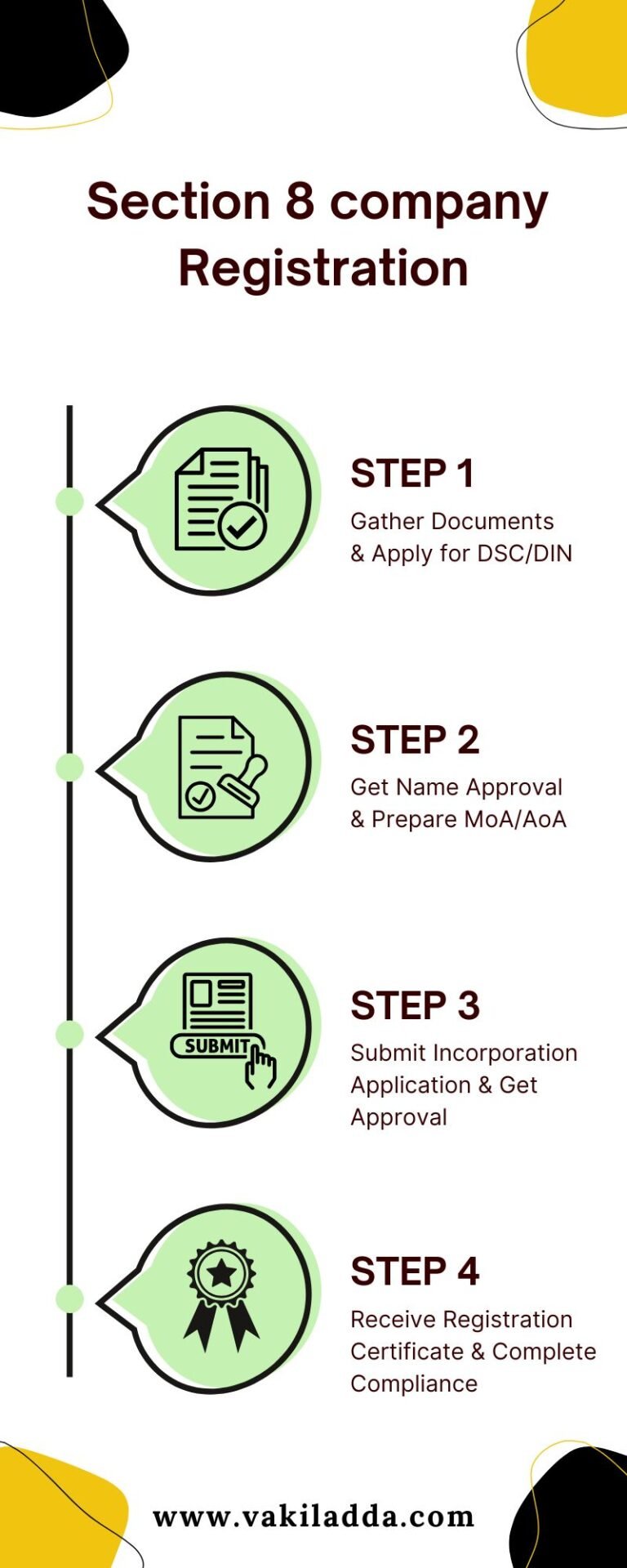

Step-by-Step Process for Section 8 Company Registration

Setting up a Section 8 Company requires following legal steps to ensure it is properly registered and operates as a non-profit under the Companies Act, 2013. Here’s a simple breakdown of the process:

- Gather Documents & Apply for DSC/DIN – Collect important documents like Aadhar, PAN, bank details, and the proposed company name. Directors must get a Digital Signature Certificate (DSC) to sign documents digitally and a Director Identification Number (DIN) to be officially recognized as company directors.

- Get Name Approval & Prepare MoA/AoA – Choose a company name and apply for approval through the RUN (Reserve Unique Name) portal on the MCA website. After approval, draft the Memorandum of Association (MoA) and Articles of Association (AoA), which outline the company’s purpose and rules.

- Submit Incorporation Application & Get Approval – Fill out and submit the SPICe+ Form along with MoA, AoA, and required documents to the Registrar of Companies (RoC). Approval from the Central Government under Section 8 of the Companies Act, 2013 is required before registration is completed.

- Receive Registration Certificate & Complete Compliance – Once approved, get the Certificate of Incorporation, PAN, and TAN. Open a company bank account, file INC-20A (Declaration of Business Commencement), and appoint an auditor (ADT-1) to manage financial compliance.

Benefits of Section 8 Company Registration

- Tax Exemption – Registered under Section 12AA of the Income Tax Act, Section 8 Companies get 100% tax exemption, meaning they don’t have to pay income tax as long as profits are used for charitable purposes.

- No Minimum Capital Requirement – Unlike other companies, there is no fixed capital requirement, allowing flexibility to start with any amount and increase as needed.

- Separate Legal Identity – A Section 8 Company has its own legal status and continues to exist even if members change, ensuring long-term stability and trust.

- High Credibility – These companies follow strict legal rules, making them more reliable than NGOs and trusts, which helps in gaining public confidence, government approvals, and funding.

- No Restriction on Name – Unlike other businesses, Section 8 Companies don’t need to add “Section 8” to their name, giving them more freedom in branding and recognition.

- Eligible for Grants & Donations – They can receive government grants, CSR (Corporate Social Responsibility) funds, and foreign donations, making it easier to fund operations and expansion.

- No Stamp Duty – No stamp duty is required for registration, reducing overall setup costs and making it more affordable to establish.

- Limited Liability – Directors and members have limited personal liability, meaning their personal assets are not at risk in case of financial losses or legal issues.

These benefits make Section 8 Companies an ideal choice for those looking to establish trustworthy, tax-exempt, and socially impactful organizations.

Vakil Adda – Expert Support for Section 8 Company Formation!

Hassle-Free Section 8 Company Registration – Get Started Today!

Looking to register a Section 8 Company in India? We’re here to help! Contact us on WhatsApp at +91 9726365800 or +91 9726365853, or call us directly for expert guidance.

With 8+ years of experience, we specialize in quick and seamless registration of Section 8 Companies. Having successfully assisted 400+ clients, including NGOs, charitable trusts, and social enterprises, we ensure 100% approval of your company registration. Our efficient process guarantees your Section 8 Company is registered within 60 days, ensuring compliance with all legal requirements.

Need additional support? We also offer office setup services to help streamline the registration process and meet compliance standards.

vakil Adda Office Team

📞 Call/WhatsApp: +91 9726365800 | +91 9726365853

Comprehensive Conclusion on Section 8 Company

A Section 8 Company is a great option for those looking to set up a legally recognized non-profit organization with structured operations and long-term sustainability. With tax benefits, no fixed capital requirement, high credibility, and access to grants and CSR funding, it provides a strong platform for social initiatives.

By following the right registration and compliance process, a Section 8 Company can function efficiently while making a lasting impact. Whether your focus is education, charity, environmental causes, sports, or community welfare, this company structure ensures legal protection and financial stability. With expert guidance, setting up a Section 8 Company can be smooth and hassle-free, allowing you to dedicate your efforts to meaningful change.