Company Statutory Audit by CA

Are you seeking a Company Statutory Audit by CA (a Chartered Accountant)? Find the best Chartered Accountant near your location for your Company Statutory Audit needs. Any form of corporate entity, whether it be a Private Limited Company, One Person Company, Section 8 Company, Public Company, Foreign Company, etc., is required to undergo compulsory Statutory Audit by a Chartered Accountant. If you are in need of a CA to complete your Company Audit Compliance, let us know; we can handle your Company Audit smoothly. Additionally, you can explore the rules of Company Audit, its applicability, document requirements, and the process of Statutory Audit here.

Looking for Company Statutory Auditor Near You?

Statutory Audit of Company

Looking for Statutory Audit Service for your Company? Every Company, as mandated by the Companies Act, 2013, is required to submit a Statutory Audit report to the Registrar of Companies (ROC). This audit must be conducted and reported by a practicing Chartered Accountant (CA). Even if there are no financial transactions in the financial year, Statutory Audit remains mandatory.

If you’re in need of a Statutory Auditor for Company Audit Service for your Private Limited Company, Public Limited Company, OPC, Section 8 Company, or LLP, look no further. We offer a comprehensive solution for all types of statutory audits in India.

The Statutory Audit Report is a key document for readers, whether they are investors, shareholders, bankers, or any other stakeholders. It outlines crucial aspects of Corporate Governance, Prudence, and business sustainability. The Statutory Auditor will report on any material aspect of corporate governance and provide their opinion on the company’s financials and corporate governance.

The main scope of Statutory Audit is to ensure:

- Compliance with Accounting Standards for the Preparation of Financial Statements.

- Adherence to Rules stated in the Companies Act by the Company.

- Compliance with all Applicable Laws (including Tax laws, Labour Law).

- Preparation and presentation of Books of Accounts as per Accounting Principles and IND-AS (if applicable).

Applicability of Statutory Audit for Company

Statutory Audit applicable to following Companies

- Private Limited Company – Statutory Audit

- One Person Company (OPC)

- Section 8 Company

- Public Company

- Limited Liability Partnership (25 Lakhs Capital or 40 Lakhs Turnover)

Statutory Auditor (CA)

As per the Companies Act, Auditor of Company called Statutory Auditor. Only Professional Chartered Accountant Can handle the work of Audit. Further, Chartered Accountant Can only handle 20 Company Audit as per the Chartered Accountant Act, 1949. Thus, CA can do audit of limited number of company. We provide assured quality service package for Company Statutory Audit by CA.

Due Date of Company Audit and Other Compliances

- Statutory Audit Completion Due Date: 30th September (This is due to the Annual General Meeting (AGM) being required to be conducted within six months of the end of the financial year).

- ITR Filing: 31st October

- AOC 4 Filing: 31st October (Within 30 Days of AGM)

- MGT 7 Filing: 30th November (Within 60 Days of AGM)

- DIN KYC and DPT 3 Filing: 30th June

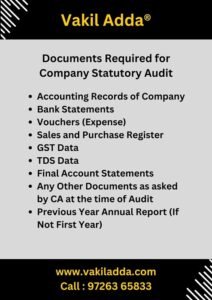

What are the Documents Required for Company Statutory Audit?

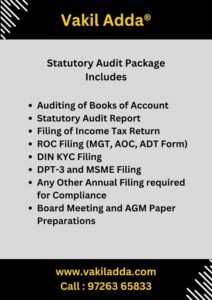

Package for Private Limited Company Statutory Audit

We provide comprehensive Services of Company Statutory Audit by CA, Our Combo Package of Rs. 19,000 Includes following services

- Auditing of Books of Account

- Statutory Audit Report

- Filing of Income Tax Return

- ROC Filing (MGT, AOC, ADT Form)

- DIN KYC Filing

- DPT-3 and MSME Filing

- Any Other Annual Filing required for Compliance

- Board Meeting and AGM Paper Preparations

Process of Statutory Audit of Company

For Company Audit, You need to send us required documents. We will analyze document and ask for any other documents if required.

Based on that, We will conduct audit procedure. Then after, we will prepare Statutory Audit report and Other Compliance Filing like ITR etc.

Within Due time, We will Complete the Audit of Company. All The Compliance will be filed on time.

Chartered Accountant Related Provisions in Companies Act

Enshrined within the Companies Act of 2013, Sections 139 through 148 are dedicated to delineating the intricacies of company audits. Here’s a succinct overview of each:

Section 139: Appointment of Auditors: This section delineates the rules and procedures governing the appointment of auditors for companies. It encompasses eligibility criteria, terms of office, and auditor rotation.

Section 140: Removal, Resignation of Auditors, and Giving of Special Notice: Addressing the removal, resignation, or special notice concerning auditors, this section outlines the requisite procedures and conditions.

Section 141: Eligibility, Qualifications, and Disqualifications of Auditors: Section 141 outlines the eligibility criteria for individuals or firms seeking auditor appointments and enumerates disqualifications for auditor roles.

Section 142: Remuneration of Auditors: This section concerns the remuneration of auditors, encompassing procedures for determining their compensation.

Section 143: Powers and Duties of Auditors and Auditing Standards: Section 143 delineates the powers, duties, and auditing standards incumbent upon auditors during audit processes.

Section 144: Auditor Not to Render Certain Services: Prohibiting auditors from providing specific non-audit services to audited companies, this section sets clear boundaries.

Section 145: Auditor’s Report: Section 145 sets forth the requisites for auditor reports, specifying content and format.

Section 146: Auditors to Attend General Meeting: Mandating auditors’ presence at company general meetings, this section underscores their role in clarifying audit-related matters.

Statutory Audit Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: Statutory Audit Consultant | Statutory Audit Consolidated Package

Frequently Asked Questions on Statutory Audit of Company

A statutory audit is an independent examination of a company’s financial records and statements to ensure compliance with legal requirements and accounting standards. It is typically conducted by a chartered accountant or a firm of chartered accountants.

The primary purpose of a statutory audit is to provide assurance to stakeholders, such as shareholders, creditors, and regulators, regarding the accuracy and reliability of the financial information presented by the audited entity. It helps maintain transparency and trust in financial reporting.

Yes, We are Providing Company Audit Service by CA Across India in all Tier 1, Tier 2 Cities. We are available with 24×7 Online Support Service. Our Main Cities of Service are Ahmedabad, Mumbai, Delhi, Bengaluru (Bangalore), Chennai, Kolkata, Hyderabad, Pune, Surat, Jaipur, Lucknow, Kochi, Indore, Visakhapatnam, and Coimbatore. We provide service in State of Jammu and Kashmir, Himachal Pradesh, Punjab, Haryana, Uttarakhand, Rajasthan, Gujarat, Maharashtra, Madhya Pradesh, Chhattisgarh, Uttar Pradesh, Bihar, Jharkhand, West Bengal, Odisha, Sikkim, Assam, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Karnataka, Andhra Pradesh, Telangana, Tamil Nadu, and Kerala.