How to Save Tax on Short-Term and Long-Term Capital Gains on Shares by Tax Harvesting ?

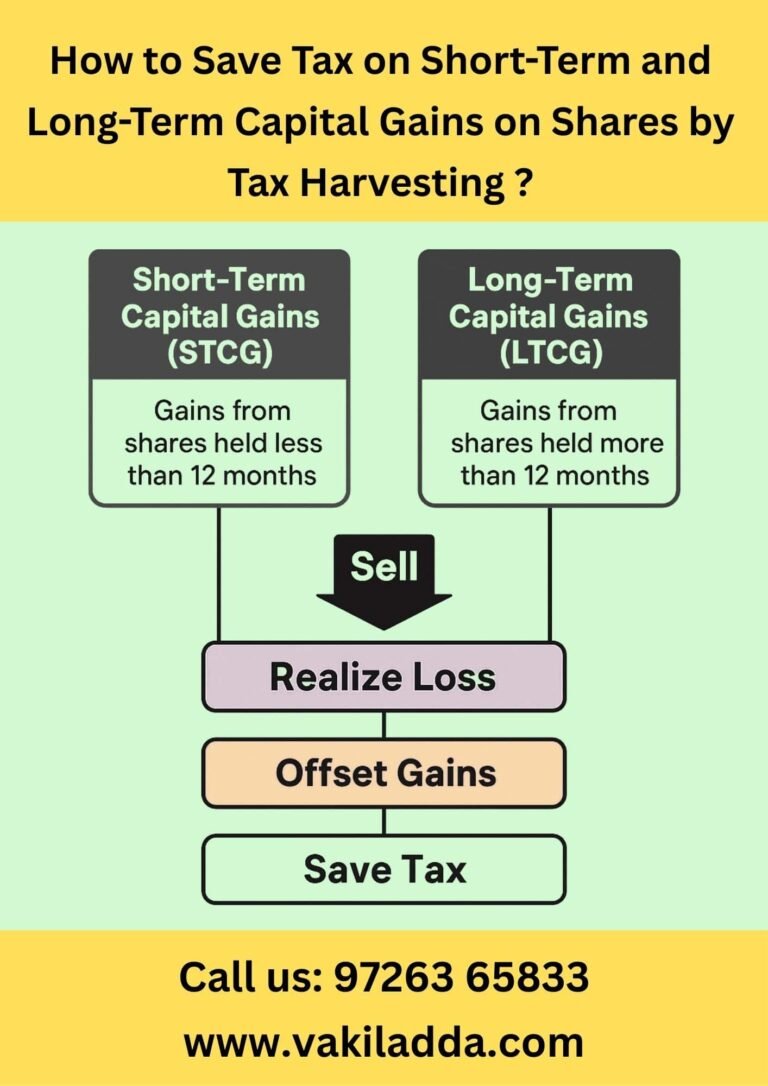

Welcome to our blog, How to Save Tax on Short-Term and Long-Term Capital Gains on Shares by Tax Harvesting.Our team is here to help you keep more of your hard-earned money and make smarter investment decisions. Tax harvesting is a legal and effective way to reduce the tax you pay on profits from your shares or mutual funds. In simple terms, it involves selling some investments at the right time to either book losses or manage gains efficiently. By doing this, you can lower your short-term and long-term capital gains tax and potentially reinvest the savings into better opportunities. In this guide, we will explain the step-by-step process of tax harvesting, the documents you need, the charges involved, and common mistakes to avoid. We’ll also share expert tips to help you plan your investments strategically, so you not only save on taxes but also grow your wealth over time.

Understanding Capital Gains Tax on Shares

Capital gains tax is the tax you pay on the profit earned when you sell shares or mutual funds. Whenever you sell an investment for more than its purchase price, the profit is considered a capital gain and is subject to tax. The amount of tax depends on how long you have held the shares and the type of shares you invest in. Knowing how capital gains tax works is important for planning your investments and minimizing tax liability.

There are two types of capital gains tax: short-term and long-term. Short-term capital gains tax applies if you sell shares within one year of purchase. These gains are taxed at a higher rate, which means careful planning is needed to avoid paying extra. Long-term capital gains tax applies if you hold shares for more than one year, and the tax rate is generally lower, with certain exemptions for gains up to a specific limit. By understanding these rules, you can make smarter decisions about when to sell your investments, how to offset gains with losses, and even reinvest to save on taxes, helping you grow your wealth more efficiently.

Short-Term vs Long-Term Capital Gains Tax

When you sell shares or mutual funds, the profit you earn is called a capital gain, and it is subject to tax. In India, capital gains are classified as short-term or long-term, depending on how long you have held the shares. Understanding the differences can help you plan your investments smartly and reduce your tax legally.

| Type of Capital Gain | Holding Period | Tax Rate in India | Key Points |

|---|---|---|---|

| Short-Term Capital Gains (STCG) | Less than 12 months | 15% | Higher tax rate; gains taxed fully; can offset short-term losses against gains. |

| Long-Term Capital Gains (LTCG) | More than 12 months | 10% (on gains above ₹1 lakh) | Lower tax rate; no indexation for listed shares; encourages long-term holding; gains up to ₹1 lakh are exempt. |

| Offsetting Losses | Both short-term & long-term | As per type of gain | Short-term losses can offset short-term or long-term gains; long-term losses can only offset long-term gains. |

| Planning Tip | Depends on investment horizon | N/A | Hold shares for more than 12 months to benefit from LTCG rates; track gains/losses carefully. |

Why Tax Harvesting is Important

Tax harvesting is a smart and legal strategy that helps investors reduce the taxes they pay on profits from shares or mutual funds. It works by offsetting gains with losses, lowering your overall taxable income. For example, if you earn ₹1 lakh in gains but have ₹30,000 in losses, your taxable gain is reduced to ₹70,000, saving you money without affecting your investments.

Besides immediate tax savings, tax harvesting also helps you restructure your portfolio by selling underperforming assets and reinvesting in better opportunities. This allows you to manage risk, improve returns, and continue growing your wealth while staying fully compliant with tax laws. By planning your transactions carefully, you can maximize profits and minimize taxes effectively.

Documents Required for Tax Harvesting

Before you start tax harvesting, it’s important to gather all the necessary documents. Having the right records ensures accurate calculation of gains and losses and helps you claim the tax benefits without any issues.

Key Documents to Keep:

Investment Statements: Statements for stocks, mutual funds, ETFs, and other investments.

Purchase and Sale Proofs: Transaction receipts showing when and at what price you bought and sold your investments.

Capital Gains Reports: Reports from brokers or fund houses detailing your gains and losses.

PAN Card & Bank Details: For identity verification and linking tax calculations to your bank account.

Brokerage Account Statements: Useful for cross-checking transactions and tax calculations.

Dividend Statements (if applicable): To track any income received from investments.

Charges for Tax Harvesting Services

The cost of tax harvesting varies based on how you decide to handle it:

Hiring a Professional: Working with a tax consultant or financial advisor can range from ₹5,000 to ₹20,000, depending on how complex your portfolio is. They provide expert guidance, so you save time and reduce the risk of mistakes.

Using Online Platforms or Robo-Advisors: Many investment platforms now offer automated tax-loss harvesting tools for a small subscription or annual fee. It’s convenient and less expensive than hiring a professional.

Do It Yourself (DIY): If you’re confident and organized, you can manage tax harvesting on your own. There’s no monetary cost, but it requires careful tracking of transactions and attention to detail.

Step-by-Step Process for Tax Harvesting

1. Identify Loss-Making Shares:

Start by reviewing your portfolio to find shares or mutual funds that have declined in value. These loss-making investments are the ones you can sell to offset gains from other profitable investments.

2. Calculate Total Gains and Losses:

Determine your overall short-term capital gains (STCG) and long-term capital gains (LTCG) for the financial year. This helps you understand how much taxable gain you can reduce by selling loss-making shares.

3. Sell Shares at a Loss:

Sell the identified shares to realize the loss, which can then be used to offset your taxable gains. This is the core step of tax harvesting.

4. Reinvest Strategically:

After selling, you can reinvest in similar shares or mutual funds to maintain your portfolio goals. Make sure to wait 30 days before repurchasing the same shares to avoid the wash sale rule, which disallows claiming the loss.

5. Report Transactions in Your Income Tax Return:

Keep all transaction records handy and report your gains and losses accurately in your Income Tax Return. Proper documentation ensures compliance and helps you claim the tax benefits correctly.

Benefits of Tax Harvesting for Investors

1. Reduces Overall Tax Liability:

By offsetting gains with losses, tax harvesting lowers the amount of capital gains tax you need to pay, helping you keep more of your investment profits.

2. Maximizes Portfolio Returns:

Tax savings directly contribute to higher net returns. By strategically managing gains and losses, you can make your portfolio more efficient and profitable.

3. Supports Long-Term Investment Goals:

Tax harvesting allows you to manage short-term tax impacts without disrupting your long-term investment strategy, keeping your financial goals on track.

4. Encourages Disciplined Portfolio Management:

Regularly reviewing gains and losses promotes a systematic approach to investing, helping you stay organized, track performance, and make informed decisions.

5. Improves Cash Flow:

Reducing taxes means more money stays in your account, which can be reinvested to grow your wealth further.

6. Helps in Risk Management:

Selling loss-making assets allows you to rebalance your portfolio, reducing exposure to underperforming investments and managing risk more effectively.

7. Provides Greater Flexibility:

Tax harvesting gives investors more control over when and how much tax they pay, allowing for smarter financial planning throughout the year.

Legal Considerations While Tax Harvesting

1. Avoid Selling Shares Repeatedly:

Do not sell shares repeatedly just to claim losses, as this could attract scrutiny from tax authorities and may be considered tax evasion.

2. Follow Wash Sale Rules:

The wash sale rule prevents you from buying the same or substantially identical shares immediately after selling at a loss. Ensure you wait at least 30 days before repurchasing to claim the loss legally.

3. Maintain Accurate Records:

Keep all transaction statements, contract notes, and capital gains statements properly organized. These documents are crucial in case the tax authorities ask for verification during an audit.

4. Offset Losses Correctly:

Ensure that short-term and long-term losses are applied against the correct type of gains as per income tax rules to avoid mistakes in your return.

5. Report All Transactions Honestly:

All gains and losses must be reported accurately in your Income Tax Return. Misreporting can lead to penalties or legal issues.

6. Consult a Tax Expert if Needed:

If your portfolio is large or complex, it’s wise to consult a tax professional to ensure compliance and optimize your tax savings without breaking any rules.

7. Avoid Using Tax Harvesting to Manipulate Income:

Tax harvesting should not be used to artificially reduce taxable income beyond legitimate limits, as aggressive strategies may attract attention from tax authorities.

Common Mistakes to Avoid for Tax Harvesting

Selling without properly calculating gains or losses.

Ignoring transaction costs, brokerage fees, or other charges.

Not maintaining proper documents for Income Tax compliance.

Violating wash sale rules by repurchasing shares too soon.

Focusing only on short-term tax savings and ignoring long-term strategy.

Overlooking rules for offsetting short-term and long-term losses.

Not consulting a tax professional when handling large or complex portfolios.

Your Trusted Consultant for Tax Harvesting

Getting professional guidance can make tax harvesting much easier and more effective. Experts help you maximize your tax savings legally, avoid common mistakes, and ensure all transactions are reported correctly. This not only saves you money but also gives you peace of mind knowing your portfolio is managed properly.

For reliable tax harvesting services, you can consult experienced professionals who understand the rules and strategies for both short-term and long-term capital gains. Visit vakiladda.com or call +91 97263 65904 to schedule a consultation and make the most of your investments while staying fully compliant with tax laws.