BOCW Registration Consultant

Are you searching for a BOCW Registration Consultant? We make the registration process simple and stress-free for construction workers and businesses. Our team helps you with all the paperwork, ensures compliance with legal requirements, and speeds up the approval process. Whether you’re a contractor, builder, or worker, we guide you through every step, making sure you get registered without any hassle. Contact us today for smooth and quick BOCW registration!

Get BOCW Registration Today!

Overview of BOCW Registration & Act Compliance

The Building and Other Construction Workers (BOCW) Act, 1996 is designed to protect construction workers by providing them with better working conditions, health benefits, and social security. If a business has 10 or more construction workers, it must register under this Act. This registration allows workers to access various government benefits like accident insurance, pensions, and educational support for their families.

Getting BOCW Registration Consultant is important to ensure legal compliance and avoid penalties. It involves submitting the required documents and following government regulations. Without registration, businesses may face legal issues, fines, or even restrictions on their operations. Proper registration not only keeps businesses compliant but also ensures that workers get financial security and a safer work environment.

As a BOCW Registration Consultant, we make the process easy and hassle-free. We help with paperwork, compliance, and quick approval so businesses and workers don’t have to worry about the complexities. Contact us today to complete your BOCW Act registration and secure benefits for your workforce!

Why Do You Need BOCW Act Registration?

BOCW (Building and Other Construction Workers) Act BOCW Registration Consultant registration is crucial for both construction businesses and workers. It provides legal recognition and ensures that workers receive essential welfare benefits such as health insurance, accident compensation, pension schemes, maternity benefits, and educational assistance for their children. Without this registration, workers may lose access to these government-provided benefits, affecting their financial security and well-being.

For businesses, BOCW registration is legally mandatory if they employ 10 or more construction workers. Failure to comply with this law can result in heavy penalties, legal fines, and even restrictions on business operations. It also ensures compliance with labor laws, preventing unnecessary disputes and liabilities. Registered businesses gain credibility, build worker trust, and foster a safer work environment, leading to better productivity and workforce stability.

Here are the key reasons why you need BOCW Act registration:

✔ Legal Compliance: Avoid penalties and legal issues.

✔ Worker Welfare Benefits: Access social security schemes for employees.

✔ Accident & Health Coverage: Ensure financial protection for workers.

✔ Maternity & Education Support: Secure benefits for workers’ families.

✔ Business Credibility: Build trust with authorities and workers.

By obtaining BOCW registration, businesses can ensure a hassle-free, compliant, and secure work environment. As a BOCW Registration Consultant, we help you with the entire process, ensuring quick approval and smooth documentation. Contact us today to complete your registration effortlessly!

Eligibility Criteria for BOCW Registration Consultants

If you want to become a BOCW Registration Consultant, you need the right expertise, legal knowledge, and business setup to assist construction businesses and workers with their registration process. Below are the key requirements to qualify as a BOCW consultant:

- Educational Background

✔ A degree or certification in law, business management, finance, or compliance is recommended.

✔ Understanding of labor laws, taxation, and the BOCW Act, 1996 is crucial for guiding clients correctly.

- Work Experience

✔ Prior experience in legal consultancy, business registration, labor law compliance, or government liaison services is highly beneficial.

✔ Knowledge of state-specific BOCW rules, registration procedures, and documentation requirements is essential for smooth processing.

✔ Experience in handling government portals, application filing, and follow-ups will help in ensuring quick approvals.

- Business & Legal Requirements

✔ Must have a registered business entity (proprietorship, partnership, LLP, or private limited company).

✔ Should obtain necessary business licenses, GST registration, and a valid professional tax certificate (if applicable).

✔ If operating in multiple states, the consultant should be aware of state-wise BOCW board requirements to provide accurate services.

- Knowledge of the BOCW Act & Compliance

✔ A consultant must thoroughly understand the BOCW Act, 1996, including its provisions for worker benefits, employer responsibilities, and compliance regulations.

✔ Awareness of welfare schemes, accident coverage, pension plans, and education benefits available under the Act is essential for guiding workers.

✔ Familiarity with legal penalties for non-compliance and ways to avoid them helps businesses stay legally compliant.

- Handling Registration & Documentation

✔ Ability to prepare and submit all required documents, such as labor details, contractor licenses, work order details, and business

registration proof.

✔ Should be skilled in filling online and offline BOCW registration applications, tracking approval status, and resolving any application issues

✔ Expertise in renewal procedures, compliance audits, and handling inspections is an added advantage.

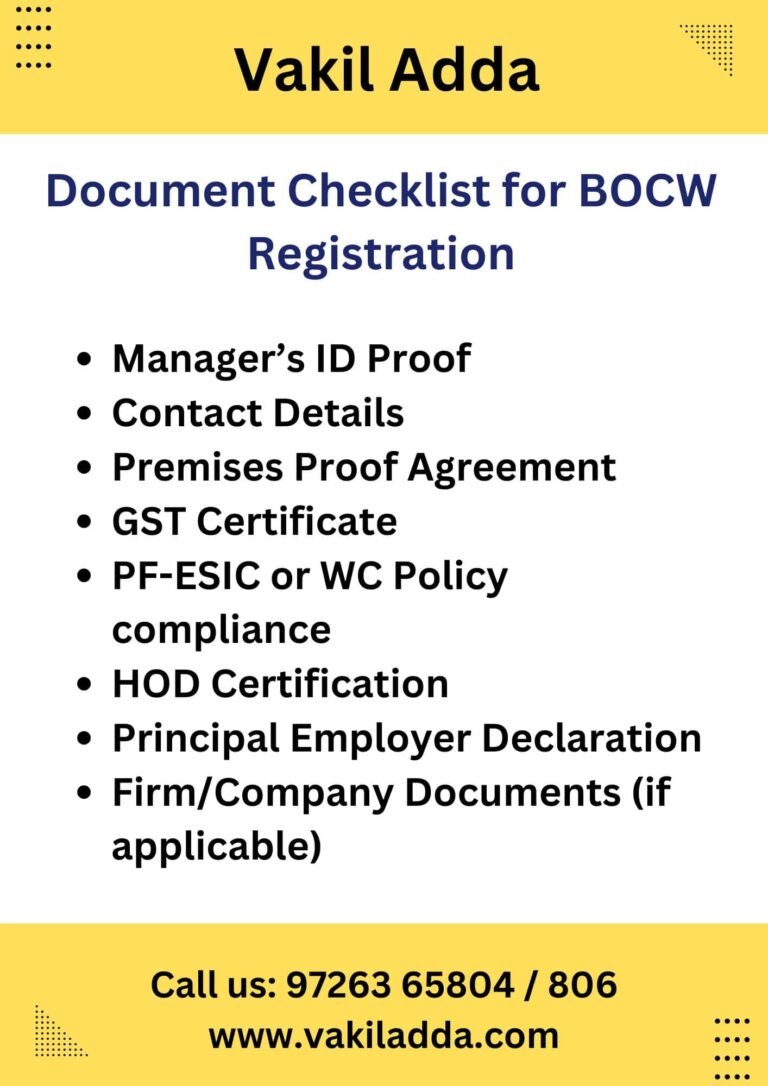

Checklist of Documents for BOCW Registration

To complete BOCW Registration Consultant, businesses must submit the necessary documents to ensure compliance with legal requirements. Proper documentation helps in smooth processing and avoids unnecessary delays. Below is the list of essential documents required:

✔ Manager’s Identity Proof – PAN Card & Aadhaar Card for verification.

✔ Contact Information – Mobile number & Email ID for official communication.

✔ Premises Proof – Electricity Bill or Rent Agreement as business location proof.

✔ GST Certificate – Required for tax compliance and business legitimacy.

✔ PF-ESIC or WC Policy – Ensures employee welfare and social security compliance.

✔ HOD Certification – Authorization letter from the Head of the Establishment.

✔ Principal Employer Declaration – Official declaration issued by the HOD.

✔ Firm/Company Documents (if applicable) – MoA, AoA, PAN, and Registration Certificate for registered entities.

Make sure all documents are properly prepared and submitted to avoid processing delays or rejections. If you need assistance with your BOCW registration, feel free to contact us!

BOCW Registration Fees & Payment Details

The government fees for BOCW (Building and Other Construction Workers) registration are determined based on the number of workers engaged in the construction process. The fee structure is as follows:

Consultancy Charges: ₹20,000/- plus ₹150 per worker

Government Application Fees:

- For 10 to 100 workers: ₹100/-

- For 101 to 500 workers: ₹500/-

- For more than 501 workers: ₹1,000/-

Building & Construction Worker Registration Procedure

Check whether you need BOCW Registration as a Contractor or Principal Employer based on your construction project’s scope and workforce size anywhere in India.fication.

Gather all the required documents and submit your application to the respective BOCW Authority in your region, ensuring compliance with their guidelines.

Once the authority reviews and approves your application, you will be granted the BOCW Registration, allowing you to proceed with your project legally and without delays.

Vakil Adda – Your Reliable Partner for BOCW Registration Consultancy

At Vakil Adda, we make BOCW Registration Consultant simple and hassle-free for contractors, builders, and businesses. Our experts handle the entire process, from document preparation to application submission, ensuring full compliance with the BOCW Act, 1996. We help you avoid legal hurdles and delays, making the registration process smooth and efficient.

With our professional support, you can secure benefits like insurance, pensions, and worker welfare schemes while ensuring legal compliance. Whether you’re a Principal Employer, Contractor, or a Construction Business, we provide expert guidance for a seamless registration experience.

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: BOCW Registration Consultant | BOCW Registration Consolidated Package

Writer: Legal Adda Office Team

Contact: +91 9726365800 – 9726365853

FAQs About BOCW Registration

BOCW Registration is required under the BOCW Act, 1996 to provide social security and benefits like insurance, pensions, and financial aid to construction workers.

Non-registration can lead to penalties, fines, and legal issues, affecting business operations.

If the project has 10 or more workers, registration is mandatory. For smaller projects, it’s optional but beneficial.