Future & Option Trader Tax Compliance in India

Welcome to Our Blog: Future & Option Trader Tax Compliance in India Trading is considered a business under Indian tax laws, meaning profits are taxed as business income based on the trader’s applicable income tax slab. To ensure compliance, traders must maintain proper records of all transactions, including profit and loss statements, brokerage charges, and other expenses. When filing income tax returns, F&O gains or losses should be reported under the “Business & Profession” category. Additionally, expenses such as internet charges, advisory fees, and office costs can be deducted to reduce taxable income. If the total turnover exceeds ₹1 crore (or ₹10 crore for digital transactions), a tax audit may be mandatory.

Losses from F&O trading can be set off against other business income or carried forward for up to eight years to offset future profits. Proper tax compliance helps traders avoid penalties and maximize tax benefits. Filing returns on time, keeping detailed financial records, and implementing smart tax planning strategies ensure smooth financial management while adhering to the Income Tax Act.

F&O Tax Audit: Do You Need One?

Tax Compliance Rules for F&O Traders in India

Futures & Options (F&O) trading in India is treated as a business, so traders must follow specific tax rules. Income from F&O trading is considered business income and is taxed based on the trader’s income tax slab rates. Turnover is calculated by adding up the absolute profits and losses from all trades, including option premiums and reverse trade differences. A tax audit is required if turnover crosses ₹10 crore (for digital transactions) or ₹1 crore (for others). It is also needed if the trader’s profit is less than 6% of turnover under the presumptive taxation scheme (for turnover up to ₹2 crore).

Traders can deduct expenses like brokerage, internet, advisory fees, and software costs to lower taxable income. If there are losses, they can be set off against other business income or carried forward for up to 8 years to reduce future tax liability. F&O traders must file ITR-3, while those opting for presumptive taxation (for turnover below ₹2 crore) can file ITR-4. GST is not applicable to F&O trading, but brokers charge GST on transaction fees. If the total tax due is more than ₹10,000, advance tax must be paid in four installments. Traders with a turnover above ₹25 lakh or an income over ₹2.5 lakh must maintain proper financial records as per Section 44AA of the Income Tax Act. Tax returns must be filed by July 31st (if no audit is needed) or October 31st (if an audit is required). Following these rules helps traders avoid penalties, save on taxes, and manage finances better.

Documents Required for F&O Tax Audit in India

For filing ITR and tax audit of Futures and Options (F&O) trading, the following documents are required:

- PAN Card

- Aadhaar Card

- Bank Details (Saving & Current Accounts)

- Stock Broker Ledger Statement

- Transaction Statement

- Profit and Loss Account (Broker App)

- Holding Statement

- Capital Gain Report or Tax Report (Broker App)

- Bank Statements (Saving and Current Accounts)

- Investment Details

- Expense Details

- Other Income Details (if any)

Tax Audit Charges for F&O Traders in India

We are a trusted Chartered Accountant service near you, specializing in ITR filing and tax audits for Futures & Options (F&O) traders. Our package, priced at ₹14,000, includes:

- Transaction Accounting – Proper recording of all F&O trades.

- Tax Audit Report – Audit certification by a Chartered Accountant.

- Income Tax Return Filing – Filing of ITR as per tax regulations.

- Digital Signature – Secure signing for online tax filings.

How to File Your F&O Tax Audit Report?

Filing an F&O tax audit report is a critical compliance requirement for traders engaged in futures and options. As per the Income Tax Act, an audit becomes mandatory if the turnover exceeds ₹10 crore in digital transactions or ₹2 crore without opting for presumptive taxation. Moreover, traders reporting losses and intending to carry them forward must also undergo a tax audit under Section 44AB. The turnover calculation for F&O trading includes absolute profits, option premiums received, and reversal transactions. Maintaining proper records, such as trading statements, profit and loss accounts, bank statements, and balance sheets, is essential to ensure a smooth audit process.

The tax audit filing process requires the expertise of a Chartered Accountant (CA), who prepares financial statements and submits the necessary forms—3CA/3CB and 3CD—on the Income Tax Portal. The trader must then approve the audit report before proceeding with the ITR-3 filing, which classifies F&O income as business income. The deadline for tax audit submission is September 30 for individuals and firms, while companies must file by October 31. Failure to comply can lead to penalties of up to ₹1.5 lakh or 0.5% of the turnover, whichever is lower. To avoid unnecessary complications, traders should ensure precise turnover calculations, maintain accurate financial records, and meet the filing deadlines. Seeking guidance from a CA can help traders optimize tax benefits while staying fully compliant with regulatory norms.

Get Your F&O Tax Audit Completed in 3 Days!

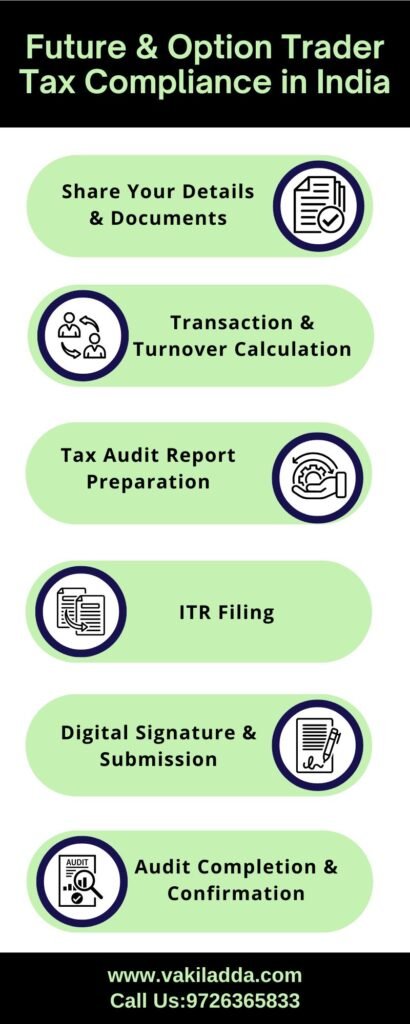

Step 1: Share Your Details & Documents

- Contact us and provide your basic details.

- Submit required documents like PAN, Aadhaar, bank statements, broker reports, and transaction details.

Step 2: Transaction Review & Turnover Calculation

- We check and record all your F&O trades.

- Turnover is calculated as per tax rules.

Step 3: Tax Audit Report Preparation

- Our Chartered Accountant (CA) prepares the Tax Audit Report (Form 3CD & 3CB).

- Your profit, loss, and tax liability are reviewed.

Step 4: ITR Filing

- Your ITR-3 is prepared and verified.

- Deductions and losses are included to reduce tax liability.

Step 5: Digital Signature & Submission

- Tax Audit Report and ITR are digitally signed.

- Everything is submitted to the Income Tax Department.

Step 6: Audit Completion & Confirmation

- You receive your ITR acknowledgment and Tax Audit Report.

Your tax compliance is secured, avoiding penalties.

Benefits of F&O Tax Audit for Traders

- Accurate Financial Reporting

A tax audit ensures that all F&O transactions are accurately recorded, leading to precise calculation of profits and losses. This accuracy is crucial for correct tax filing and financial analysis. - Loss Carry Forward

Reporting F&O losses through a tax audit allows traders to carry forward these losses for up to eight years. These losses can be offset against future profits, reducing taxable income in subsequent years. - Compliance with Tax Laws

A tax audit ensures adherence to the Income Tax Act’s provisions, reducing the risk of penalties or legal issues due to non-compliance. - Enhanced Credibility

Having audited financial statements enhances a trader’s credibility with financial institutions, which can be beneficial when seeking loans or other financial services.Conducting a tax audit for Futures & Options (F&O) trading offers several benefits for traders:

Informed Decision Making

An audit provides a clear financial picture, enabling traders to make informed decisions regarding their trading strategies and financial planning.

Conclusion: Importance of F&O Tax Audit for Traders

Conducting a tax audit for Futures & Options (F&O) trading is crucial for traders to ensure compliance with tax laws and to optimize financial outcomes. An F&O tax audit facilitates accurate financial reporting, enabling precise calculation of profits and losses, which is essential for correct tax filing and financial analysis. Moreover, it allows traders to carry forward losses for up to eight years, offsetting future profits and reducing taxable income in subsequent years. By adhering to the Income Tax Act’s provisions, traders minimize the risk of penalties or legal issues due to non-compliance. Additionally, having audited financial statements enhances credibility with financial institutions, aiding in securing loans or other financial services. Overall, an F&O tax audit not only ensures compliance with tax regulations but also offers strategic advantages that can contribute to a trader’s financial success.

Vakil Adda: Your Trusted Partner for F&O Tax Audit

Vakil Adda provides quick and easy tax audit services for Futures & Options (F&O) traders. Our team of experienced Chartered Accountants (CAs) ensures your tax filing is accurate and completed on time. We help traders calculate turnover, prepare audit reports, and file income tax returns smoothly. Our process is fast, reliable, and completed within 3 days, so you don’t have to worry about delays.

Our F&O tax audit package includes transaction accounting, tax audit report preparation (Form 3CD & 3CB), ITR-3 filing, and digital signature (DSC) assistance. This ensures that traders follow tax laws correctly while also claiming deductions on expenses like brokerage fees and advisory charges. A tax audit is required if your turnover exceeds ₹10 crore (for digital transactions) or ₹1 crore (for other cases). It is also needed if you opt for presumptive taxation but declare profits below 6% of turnover.

With affordable fees, expert support, and complete tax compliance, Vakil Adda helps traders avoid penalties and maximize tax benefits. Let us take care of your F&O tax audit quickly and efficiently – contact us today!

Writer: Legal Adda Office Team

Contact: +91 9726365800 – 9726365853