Everything About One Person Company (OPC) Registration Consultant

Welcome to this blog on One Person Company (OPC) Registration Consultant! If you’re an individual looking to start your own business, an OPC is a great choice as it allows you to be the sole owner while giving your business legal status and protection. Unlike a sole proprietorship, it offers more credibility, financial security, and business stability, helping build trust with clients and investors. The registration process is simple, requiring basic documents and government approvals, and it has fewer rules than a private limited company, making it an easy and hassle-free option. Ideal for freelancers, consultants, and small business owners, an OPC provides a professional identity while keeping personal assets safe. It also offers tax benefits, minimal legal formalities, and easy ownership transfer if needed. With full control over decision-making and government support for startups, registering an OPC is now simpler and more beneficial for entrepreneurs.

OPC Registration in 3 Days – Start Your Business Fast!

One Person Company (OPC) Under Companies Act, 2013

The Companies Act, 2013 brought a major change in India’s business laws by introducing the One Person Company (OPC) Registration Consultant. As per Section 2(62), an OPC can be formed with just one director and one member, both of whom can be the same person. This means that a single individual can now set up a company with limited liability, perpetual succession, and a separate legal identity, making it a safer and more credible option than a sole proprietorship.

Before this law, starting a company required at least two members and two directors for a private company and three directors with seven members for a public company. This meant solo entrepreneurs could only run a sole proprietorship, which had no legal recognition and put their personal assets at risk. With the introduction of OPC, a single person—whether an Indian resident or NRI—can start a legally recognized company with fewer rules and compliance requirements than a private limited company.

By introducing OPCs, the Indian government provided small business owners, freelancers, and startups with an easy way to register their businesses while enjoying the legal and financial benefits of a company.

Key Advantages of One Person Company (OPC)

If you’re a solo entrepreneur looking to start a business, a One Person Company (OPC) is a great option. It gives you the benefits of a company while keeping things simple. Here’s why an OPC can be the right choice for you:

- Your Personal Assets Are Safe

Unlike a sole proprietorship, your personal belongings (like your home or savings) won’t be at risk if the business faces losses. - Recognized as a Separate Business

An OPC is legally considered a separate company, meaning you can own property, enter contracts, and even take legal action in the company’s name. - Your Business Keeps Running

Even if something happens to you, the company won’t shut down immediately. A nominee (someone you choose) can take over and keep it going. - Easy to Run

Since there’s only one owner, you don’t need to consult partners or shareholders before making decisions. You have full control. - Less Legal Hassle

OPCs have fewer paperwork and compliance requirements compared to private limited companies, making them easier to manage. - Builds Trust and Credibility

An OPC looks more professional and trustworthy compared to a sole proprietorship, making it easier to get clients, investors, or business loans. - Tax Benefits

OPCs may get tax deductions and exemptions, saving you money compared to sole proprietorships. - Easier to Get Loans and Investments

Banks and investors prefer giving funds to a registered company rather than an unregistered business. - Quick and Simple Registration

Setting up an OPC is much easier than other business structures, requiring minimal paperwork.

If you want to start a business on your own but still enjoy the benefits of a registered company, an OPC is a smart and secure choice!

Documents Needed for One Person Company (OPC) Registration

How Much Does It Cost to Register an OPC?

We make One Person Company (OPC) Registration Consultant registration simple and stress-free anywhere in India. Our expert team handles the entire process smoothly. Get your OPC registered for just ₹10,000, with no hidden fees or upfront payments. Our all-in-one package includes:

✔ Complete OPC Registration

✔ MoA & AoA Preparation

✔ Company Name Approval

✔ All Government Fees & Stamp Duty Covered

✔ PAN & TAN Registration

✔ PF & ESIC Registration

✔ MSME Registration

✔ DIN (Director Identification Number)

✔ Digital Signature (DSC)

✔ Help with Opening a Business Bank Account

✔ INC-20A Filing

✔ ADT-1 Filing

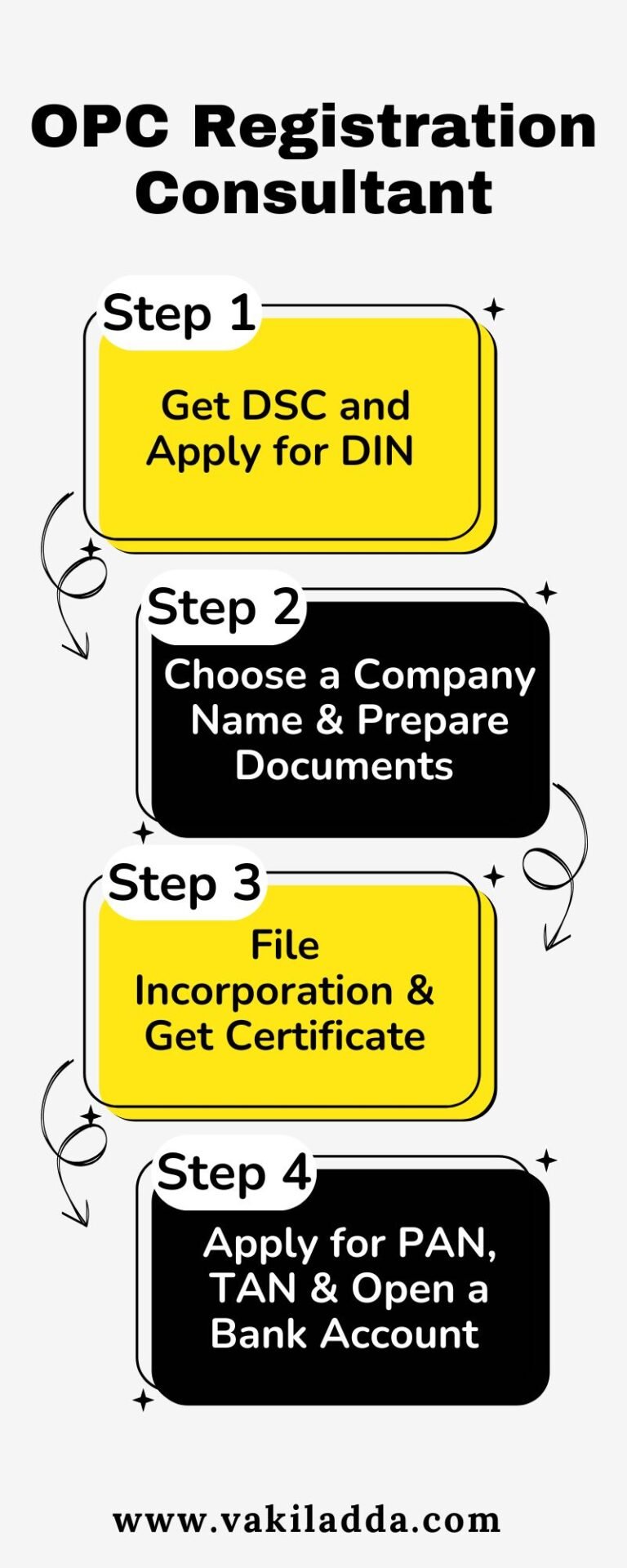

Procedure for One Person Company (OPC) Registration

- Get DSC and Apply for DIN : The owner must obtain a Digital Signature Certificate (DSC) to sign documents electronically. Then, apply for a Director Identification Number (DIN), which is mandatory for becoming the company’s director. These are essential for online company registration.

- Choose a Company Name & Prepare Documents: Select a unique name for the company and get approval from the Ministry of Corporate Affairs (MCA). Once approved, draft the Memorandum of Association (MoA) and Articles of Association (AoA), which outline the company’s objectives and rules.

- File Incorporation & Get Certificate: Submit the SPICe+ form along with all necessary documents on the MCA portal. After verification, the Registrar of Companies (ROC) issues the Certificate of Incorporation, officially registering the OPC and providing a Corporate Identification Number (CIN).

- Apply for PAN, TAN & Open a Bank Account: Apply for Permanent Account Number (PAN) and Tax Deduction Account Number (TAN) for tax compliance. Open a business bank account using company documents, and register for GST if turnover exceeds the threshold. Your OPC is now ready to operate legally!

Roles of the Owner and Nominee in a One Person Company (OPC)

In a One Person Company (OPC) Registration Consultant, everything revolves around a single person, but there’s also a backup plan in place. Here’s how it works

- Owner (Director & Shareholder)

- The owner is the one and only boss of the company.

- They make all the decisions, handle business operations, and take responsibility for its success.

- Their personal assets are safe, as they are only liable for the company’s debts up to their investment.

- They can hire employees and expand the business just like any other company.

- Nominee (Backup Owner)

- A nominee is a person the owner chooses at the time of registration as a backup.

- They don’t interfere in business activities but are ready to step in if the owner is unable to manage the company due to death or incapacity.

- If something happens to the owner, the nominee automatically takes over the company or can transfer it to someone else.

This setup ensures that an OPC runs smoothly and stays secure, even when there is only one person managing it.

Important Guidelines for One Person Company (OPC) Registration

Guidelines for setting up a One Person Company (OPC) Registration Consultant ensure smooth registration and legal compliance. The company must have only one owner, who acts as both the shareholder and director. However, appointing a nominee is mandatory, as they will take over the company in case the owner is unable to continue. Before registration, the company name must be approved by the Ministry of Corporate Affairs (MCA) to ensure it is unique. An OPC enjoys limited liability protection, meaning the owner’s personal assets are safe from business debts. Additionally, a registered office address is required, which can be verified using an electricity, telephone, or internet bill.

Guidelines also require an OPC to follow basic compliance rules, such as filing annual returns, maintaining financial records, and adhering to tax regulations. If the company’s growth reaches a certain limit, it must be converted into a private or public company. The company must also obtain PAN, TAN, and register for GST if applicable. A business bank account is required to keep financial transactions separate. Following these guidelines ensures a legally compliant OPC, allowing the owner to focus on business growth without legal hassles.

Vakil Adda – Reliable Assistance for OPC Registration

Want to register your One Person Company (OPC) Registration Consultant in India? Vakil Adda is here to make it easy! With over 8 years of experience and 400+ successful registrations, we specialize in quick and straightforward OPC registration. Our team guarantees that your OPC registration will be approved, and we’ll handle everything to make sure it’s done right.

We take care of all the details, from choosing a name to filing documents with the Ministry of Corporate Affairs (MCA). We ensure your OPC is registered quickly, usually within 60 days, and meets all legal requirements.

Need help with more than just registration? We also offer office setup services to help with compliance. Whether you’re just starting out or need assistance with your business, Vakil Adda is here to make your OPC registration process smooth and simple.

Reach out to us today on WhatsApp at +91 9726365800 | +91 9726365853 or call us for expert help!