Hindu Undivided Family (HUF) Formation

Are you looking for HUF Formation Consultant in India? We are leading consultants specializing in HUF creation services. Establish your HUF with seamless guidance on the formation process, legal documentation, compliance requirements, and associated procedures. Connect with our expert team, including Chartered Accountants and legal professionals, to ensure a smooth establishment of your HUF in accordance with Hindu family laws and regulations.

Get Consultation for HUF Registration

Hindu Undivided Family - HUF Rules

HUF stands for Hindu Undivided Family. Recognized under Hindu law, an HUF constitutes a legal entity formed by a family connected through common ancestry and shared living arrangements. In the context of Indian taxation, the Income Tax Act recognizes HUF as an independent taxable entity with a designated PAN (Permanent Account Number) for tax-related matters.

A Hindu Undivided Family is automatically formed when a person gets married and starts a family. Thus, there is no requirement that the family should have children; when a marriage happens, an HUF comes into existence. An HUF is a separate legal entity managed and operated by the Karta, who is the eldest member of the family. Karta holds the rights of transaction of assets of HUF.

Small family businesses, investment businesses, shares trading, or IPOs are common business interests that lead to the formation of an HUF through an HUF Deed. Contact us for HUF Formation Consultant & (HUF) registration process across India.

Criteria for Registering a HUF (Firm)

Only the following conditions must be met for the formation of an HUF:

- The family’s caste must be Hindu, Buddhist, Jain, or Sikh.

- The person must be married OR have children (Either condition must be satisfied).

- There must be assets in the name of the family.

Benefits of Hindu Undivided Family - HUF Registration

HUF has unique benefits that can be identified as:

Tax Saving Option – HUF is a separate legal entity with a distinct threshold limit of Rs. 250,000, which aids in tax savings.

Equal Member Rights – Members have equal rights to the assets of the HUF.

In today’s scenario, the craze for IPOs has increased, so HUF can submit a separate IPO or SME IPO application.

HUF Creation Process

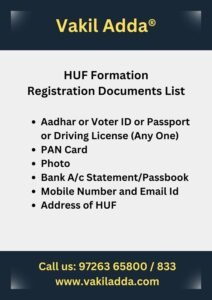

Our Representative will connect with you for document collection and preparation of HUF Deed.

The Karta and other members will finalize the HUF draft, and after that, members will sign it, followed by the stamping process.

We will process HUF Creation, PAN Card and Bank Account for your HUF. We also helps in compliance of HUF on requirement.

What are the compliance required for HUF after creation?

Compliance of HUF is easy and smooth, As Only Income Tax Return Required to file if the HUF income is more than basic exemption of Income tax.

HUF Registration Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: HUF Registration Consultant | HUF Registration Consolidated Package

Interested in HUF Creation - Download Proposal

Frequently Asked Questions on HUF Formation Consultant

No, HUF Formation cannot be done by Muslim family.

Yes, HUF can invest in Shares via DEMAT Account. Also HUF can apply for Initial Public Offers – IPO.

Yes, We are nationwide HUF Formation Consultant Providing HUF Registration Service Across India.