GST Audit by CA

Are you looking for GST Audit by CA? Get Chartered Accountant Service for Goods and Services Tax Audit. Business with the turnover higher than Rupees five crore required compulsory GST Audit. GST audit can be conducted by Chartered Accountant (CA) or Cost Accountant (CMA). If you are GST Registered Unit and you are in search of Auditor for GST Connect with us. We can provide you GSTR-9 and GSTR-9C Filing Service. Explore here Rules of GST Audit, Applicability, Due Date and Process of Audit.

Looking for GST Audit Service?

GST Audit

Goods and Services Tax (GST) Audit ensures that taxpayers have followed provisions and rules stated in the Goods and Services Tax Act, 2017. Every registered taxpayer whose aggregate turnover exceeds the specified limit (currently Rs. 5 Crore) is required to get their GST audit done mandatorily. GST audit is required to be filed annually in GSTR-9C, with the due date of GST audit being 31st December.

The main parameter of GST audit is to check whether the taxpayer has paid the GST amount as per the applicable rate and value, whether the taxpayer has availed input tax credit as per the GST provisions, and whether the GST refund amount is in line with allowable refund, etc. We provide a comprehensive solution for GST annual filing, including GSTR-9 and GSTR-9C. Contact us for your GST-related consultancy requirements.

Applicability of GST Audit

GST Audit Mandatorily Apply to following Person/Company

- Aggregate Turnover in financial year is more than Rs. 5 Crore

- To calculate the aggregate turnover, you add up the value of all taxable supplies (both within the state and between states), along with exempt supplies and exports of all goods and services. This gives you a total picture of the business’s turnover, including all types of transactions.

Due Date of Filing of GST Annual Return & Audit

GST annual returns must be filed before following due dates:

- Annual Return Statement GSTR-9: Must be filed before 31st December.

- GST Audit Statement GSTR-9C: Must be filed before 31st December.

- GSTR-9A: Annual Return for Composition Tax Payers – Due date is 31st December.

- GSTR-9B: Annual Return for e-commerce operators (required to deduct TDS) – Due date is 31st December.

Ensuring timely submission of these returns is essential to maintain compliance with GST regulations and avoid penalties.

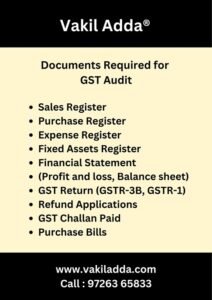

What Are the Documents Required for GST Audit?

Following documents required for GST Audit Procedure by Chartered Accountant

- Sales Register

- Purchase Register

- Expense Register

- Fixed Assets Register

- Financial Statement (Profit and loss, Balance sheet)

- GST Returns (GSTR-3B, GSTR-1 and GSTR-2A)

- Refund Applications

- GST Challan Paid

- Purchase Bills

- Any Other Details as asked by CA during Audit Process

Process of GST Audit (GSTR-9C)

Send us relevant document for GST Audit as stated in Audit Checklist.

Our Chartered Accountant Team will conduct audit process as per requirement.

We will submit relevant Annual GST Filing with GST Audit in Form GSTR-9C.

Chartered Accountants Expertise in GST Audit

Chartered Accountants are experts in handling GST audits. They help ensure that businesses follow all the rules correctly. If you need a GST audit service, you can find us as CA nearby who can provide the help you need. Their expertise makes sure that everything is done right, giving you peace of mind about your taxes.

GST Audit Consultant Near You

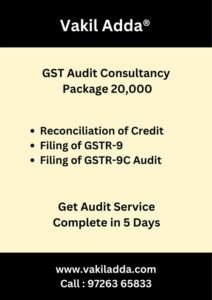

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: GST Audit Consultant | GST Audit Consolidated Package

Frequently Asked Questions on GST Audit

Yes, Turnover Calculation must be done combinedly. In Above Case Audit Will Be applicable.