CA Net Worth Certificate for DEMAT

Are you in need of a CA Net Worth Certificate for DEMAT, investment, Bank Account, RBI, SEBI Requirement or trading account? Obtain an instant Net Worth Certificate for various purposes, including DEMAT, investment, and trading account openings for your partnership firm, LLP, private limited company, or personal use. We offer comprehensive net worth certificate consultancy with guaranteed same-day delivery. Additionally, we adhere to a uniform pricing policy for Investment and DEMAT purpose Net Worth Certificates, priced at only Rs. 2000. Contact us now to receive your certificate within one hour.

Get CA Net Worth Certificate - Just in One Hour

Net Worth Certificate for Investment/Bank/DEMAT Account

As per the Latest Guidelines of SEBI, Every Future and Options Trader, High Net Worth Individuals, Research Analyst etc required to submit Net Worth Certificate of Chartered Accountant. Purpose of Such Certificate is to check assurance on fulfillment of contractual obligation arising out of capital market transactions. Risk wise trading activation can only be done by broker after checking wealth statement of investor.

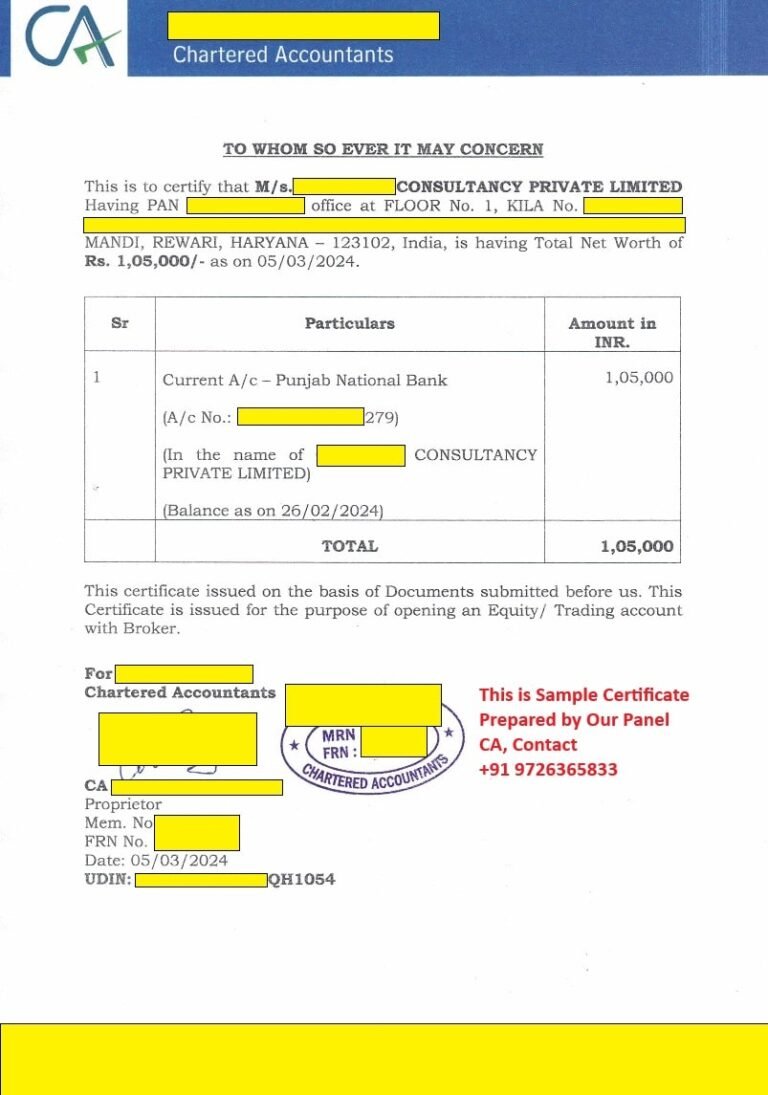

When navigating the process of securing a Net Worth Certificate for Investment/Trading/DEMAT accounts, it’s essential to navigate through the array of regulations stipulated by the Securities and Exchange Board of India (SEBI). These guidelines provide a framework ensuring financial transparency and reliability. SEBI mandates that individuals or entities seeking to open such accounts must furnish a Net Worth Certificate, serving as a litmus test for their financial standing and eligibility in capital markets transactions. This certificate, obtained from a qualified Chartered Accountant (CA) in compliance with SEBI’s prescribed formats, underscores the applicant’s financial capability and plays a pivotal role in regulatory compliance. Additionally, SEBI-regulated validity periods ensure periodic reviews, updating the applicant’s financial standing for ongoing market participation.

Amidst the labyrinth of SEBI’s regulations, the role of the Chartered Accountant (CA) emerges as indispensable. Entrusted with the assessment of financial statements, the CA meticulously evaluates balance sheets, profit and loss statements, and other pertinent documents to ascertain the applicant’s net worth. Furthermore, the CA meticulously verifies assets and liabilities declared by the applicant, ensuring accuracy and completeness in the net worth calculation. Upon completion of the assessment, the CA issues a Net Worth Certificate, attesting to the applicant’s financial standing, all while adhering to SEBI’s guidelines. This comprehensive certificate, enriched with applicant details, financial summaries, and the CA’s certification, not only bolsters transparency but also underscores the reliability essential for navigating the complex landscape of trading securities.

Use Case of Net Worth Certificate?

Followings are the usefulness of DEMAT and Other Purpose Net Worth Certificate By CA

- Opening of DEMAT Account

- Opening of Trading Account with Broker

- Investment Account with Certain high Risk Transactions

- To Become SEBI Research Analyst

- Other SEBI Requirement

- Bank Account Opening of Corporate Entity Like Private Limited Company, LLP, Partnership Firm etc.

- VISA Purpose Net Worth Statement

Net Worth Certificate Requirement of Entity

Corporate and Partnership Firms requires Net Worth Certificate for DEMAT, Bank Account Opening, Investment and Trading Purpose for

- Partnership Firm

- Limited Liability Partnership (LLP)

- Private Limited Company

- Trust or AOP or BOI

- Public Limited Company

- Proprietorship Firm

Consultancy Fees for DEMAT, SEBI & Investment Purpose Net Worth Certificate

Chartered Accountant Fees for Bank Account Opening, DEMAT and Trading Account, SEBI, RBI Related Registration or Investment Account Opening Purpose;

Rs. 2000/- (Inclusive of All)

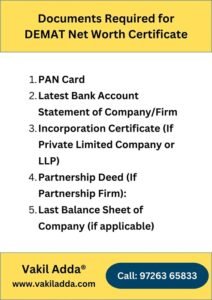

What Are the Documents Required for DEMAT Purpose Net Worth Certificate?

In order to prepare a comprehensive Net Worth Certificate for Partnership Firms, LLPs, Trusts, HUFs, Person/Individual or Companies, Following Documents are Essential

- PAN Card

- Latest Bank Account Statement

- Proof of Assets (Movable or Immovable)

- Latest Balance Sheet (If Available)

- Partnership Deed (if Partnership Firm)

- Incorporation Certificate (if Company or LLP)

Get Net Worth Certificate Instantly - Online Process

SEBI Rules of Research Advisory Net Worth Certificate

SEBI, the guardian of financial integrity in India, maintains a vigilant eye over the realm of research analysts and advisors, ensuring they navigate the market waters with integrity and competence. Among the myriad prerequisites demanded by SEBI for aspiring research analysts or advisors, the net worth certificate shines as a beacon of financial fortitude.

Crafted meticulously by seasoned chartered accountants or diligent company secretaries, the net worth certificate stands as a testament to the fiscal strength of the applicant. It serves as a key that must unlock the door to SEBI’s approval, revealing a net worth robust enough to weather the storms of the financial world.

Yet, in this ever-evolving landscape of regulations and guidelines, the rules governing this essential document may have morphed since last we checked. Therefore, to navigate the labyrinth of SEBI’s requirements with certainty, one must consult not only the latest directives issued by SEBI but also the sagacious counsel of legal experts who traverse these regulatory waters with finesse.

For those who dare to tread the path of research analysis or advisory services, SEBI’s mandate for minimum net worth is a hurdle to be cleared, a test of financial mettle. And within the folds of that net worth certificate lies the verdict of SEBI’s approval, a seal of legitimacy in the realm of financial wisdom.

Net Worth Certificate For DEMAT Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: Net Worth Certificate For DEMAT Consultant | Net Worth Certificate For DEMAT Consolidated Package