Book Keeping Service

Are you seeking book keeping service for your business financials? We are India’s most trusted Accounting firm providing comprehensive financial accounting solutions. Whether you are trader, service provider or professionals we have accounting expert who can help your companies book keeping. We are familiar with all kind of accounting software including QuickBooks, Zoho Books, Tally ERP, Xero, SAP etc.

Contact us and get Virtual Accountant for your Company Book Keeping.

Get Virtual Accountant for Book Keeping

Comprehensive Book Keeping Solutions

Having up-to-date accounting and financial records is a must for a business to run smoothly. Our Book Keeping Service is here to assist, ensuring all transactions, like sales and purchases, are properly recorded. This helps in understanding profit, client payments, bills to vendors, and the necessary tax returns and audits. Accounting is the main tool for making informed decisions to improve your business.

According to the laws of each country, businesses need to handle sales tax filings, goods and service tax filings, payroll, income tax, and audits. Bookkeeping makes these tasks easy and error-free. It also helps investors grasp their business growth.

But, for small businesses and professionals, hiring an in-house accountant can be costly. That’s where we come in with our complete Accounting Solution. We handle proper entry, review by CPA/CA professionals, filings, and detailed reporting. Get the convenience of outsourcing with a dedicated Virtual Accountant.

Benefits of Maintaining Proper Books of Account

Efficient Accounting Practices Can Help in the Following Ways:

Facilitates easy comprehension of financial elements such as sales, profit, margin, expenses, and balances.

Simplifies Sales Tax and Income Tax filings by maintaining organized and accessible financial records.

Enables auditors to conduct efficient and accurate financial audits of the company.

Assists investors and founders in easily interpreting and analyzing the current business situation.

Aids in the loan application process, as proper financial records are mandatory for approval.

Facilitates the early detection of fraud and errors within the financial records.

Implementing efficient accounting practices offers comprehensive benefits for businesses in managing their financial affairs.

Small Business Accounting - Outsource us

Managing in-house accounting for small businesses, doctors, and professionals can be a significant cost hurdle when financial transactions are minimal. Our online accounting packages offer comprehensive bookkeeping solutions, aiding in the cost minimization process. Let’s explore the advantages of outsourcing accounting work.

While in-house accountants may have limited knowledge specific to an industry, outsourcing to an accounting firm brings expertise from professionals like CA/CPA, ensuring guidance and thorough reviews tailored to specific industry practices.

In-house departments often face high costs for maintaining a comparable standard of work. Outsourcing accounting proves to be a more cost-effective and efficient solution.

Outsourcing ensures regular and timely reporting, along with efficient handling of tax filings.

Access expert advice on various financial transactions, providing valuable insights for informed decision-making.

The outsourcing department includes review teams that contribute to nullifying errors, ensuring accuracy and compliance.

By outsourcing accounting responsibilities, businesses can benefit from cost savings, industry-specific expertise, and efficient financial management tailored to their unique needs. Further, Owner can more focus on operational function rather on admin and accounting functions.

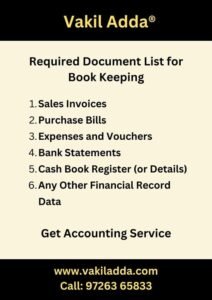

What documents are required to maintain proper accounting records?

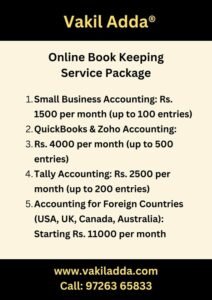

Explore Our Online Book Keeping Service Packages

The Accounting Service Package is based on the volume (number) of transactions. We provide virtual accountants and auditors at very reasonable fees.

- Small Business Accounting: Rs. 1500 per month (up to 100 entries per month)

- QuickBooks and Zoho Accounting: Rs. 4000 per month (up to 500 entries)

- Tally Accounting: Rs. 2500 per month (up to 200 entries)

- Accounting for Foreign Countries (USA, UK, Canada, Australia): Starting from Rs. 11000 per month

Our Method of Rendering Book Keeping Services

Our team will prepare a checklist of documents based on the company’s activities. Additionally, we will assign a dedicated Accounting Manager for ongoing support.

According to the provided list, you are required to send us the necessary documents at agreed intervals—whether weekly, monthly, quarterly, or yearly. Subsequently, we will prepare the books of accounts, and our experts will thoroughly review them before forwarding the finalized documents to you

Once our CA/CPA team finalizes the accounting records, we will forward reports to your team and/or tax filing department according to your requirements.

Outsourced Bookkeeping Services for Foreign Companies

We are the largest accounting firm in India, offering bookkeeping services to clients both domestically and globally. Our expertise extends to Business-to-Business (B2B) accounting consultancy, where international accounting firms outsource their clients’ bookkeeping to us. This not only reduces costs for them but also enhances efficiency, opening up opportunities for acquiring more clients. We specialize in accounting services for several major countries, ensuring comprehensive support for your business.

- United States of America (USA)

- Canada

- Australia

- United Kingdom (England)

- Germany

- Singapore

Accounting Bookkeeping Services Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: Accounting Bookkeeping Consultant Accounting Bookkeeping Consolidated Pacakge Package

FAQ's on Book Keeping Services

Accounting record-keeping is mandatory according to the form of the entity. However, some businesses on a very small scale can choose to avoid accounting. Nevertheless, it is always advisable to maintain accounting.

We are familiar with all Online, Virtual and offline Accounting Software Including Zoho Books, Quickbooks, SAP, XERO, Tally, ERP etc.

Yes, Our Team comprises Accounting Experts like Certified Public Accountant (CPA) from Various developed countries, Chartered Accountants etc.

Yes, We are providing Accounting Services across India all cities.