ROC Filing Consultant

Are you in need of an ROC Filing Consultant? Our team of Chartered Accountants and Company Secretaries provides a comprehensive solution for Registrar of Companies (ROC) Filing. Whether you operate a Private Limited Company, OPC, Section 8 Company, or LLP, filing with the Registrar of Companies is essential for updating business particulars or annual compliance. We offer complete MCA Portal-based ROC Filing solutions across India. Connect with us now.

Required Consultant for ROC Filing?

Registrar of Company (ROC) Filing

“The Registrar of Companies manages company compliance through its MCA21 Portal. All registered companies or LLPs are required to file their Annual Returns, Event-Based forms, and submit information via the MCA portal. Such filings must be digitally signed in the prescribed format, along with payment of government fees for the form.

With the transition from version 2.0 to 3.0, all LLP and Company forms are now completely electronic, and form preparation is directly available through the MCA21 portal. Filing options are available for LLPs, companies, auditors, company secretaries, and directors.

ROC Filing Required when Business Address Changes, Director Addition or removal, Auditor Appointment/Resignation, Object Clause Changes, Charge Creation, Name Change, Annual Filings etc.

RoC Filing/Intimation is mandatory, and any delay in filing may result in penalties. Some popular ROC Filings include DIN KYC for Directors, LLP Form 8 and Form 11 Filings, Annual Filings of Company MGT and AOC Forms, Auditor Filings ADT-1 and ADT-3, etc. If you are seeking a ROC Filing Consultant, Vakil Adda is the best place to ensure your ROC Compliance.”

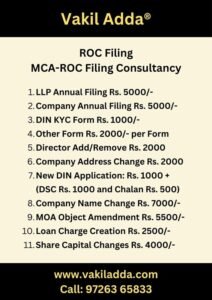

ROC Filing Fees & Charges

We Charges Rs. 2000/- Consultancy Fees for Each form of MCA-ROC. However, Following as specific Pricing Structure

- LLP Annual Filing (Form 8 and Form 11): Rs. 5000/-

- Company Annual Filing (AOC-4 and MGT-7): Rs. 5000/-

- DIN KYC Form: Rs. 1000/-

- Any Other Form Rs. 2000/- Per Form

- Director Addition or Removal: Rs. 2000 Per Form

- Company Address Change: Rs. 2000

- New DIN Application: Rs. 1000 (Plus: DSC Rs. 1000 and Govt Chalan Rs. 500 Additional)

- Company Name Change: Rs. 7000/-

- MOA Object Change/Amendment: Rs. 5500/-

- Loan Charge Creation: Rs. 2500/-

- Share Capital Changes: Rs. 4000/-

What Are the Documents Required for ROC Filing?

Depend on the filing of Form documents vary, However some of common documents and details are as

- Duly Signed Board Resolutions

- In Case of Director Appointment or Removal: Appointment and Resignation Letter

- Digital Signature of Directors

- Address Change (Latest Electricity or Utility Bill)

Important ROC Forms

Let’s Check Important ROC Forms

- INC-20A: Business Commencement

- ADT-1: Auditor Appointment

- MGT and AOC: Annual Filing of Company

- Form 8 & 11: LLP Annual Filing

- DIR-12: Change in Director/KMP

- DIR-3: New DIN Application

- SH-7: Share Capital Alteration

- ADT-3: Auditor Resignation

- CHG-1: Loan Charge Creation

- INC-22: Change in Address

- DPT-3: Loan Return

- MSME: Creditors of MSME Category

- DIN KYC: Annual KYC of Directors

Annual Compliance ROC Filings

Annual Compliance of LLP

- Form 8

- Form 11

Annual Compliance of Company

- MGT-7A

- AOC-4

(DIN KYC Compulsory for all directors)

Obtain ROC Filing Service

Send us required documents for ROC MCA Filing.

Our CA/CS team will prepare Form for Filing.

Online Submission of form with digital signature.

Event/Change Base ROC Filing Requirements

There are many event based form filing required. However some of popular event/change base ROC Filings are

- Director Addition

- Director Removal

- Company Address Change

- Auditor Changes

- Share Capital Alteration

- Loan Charge Creation

- Company Object Change

ROC Filing Consultant Near You

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: ROC Filing Consultant | ROC Filing Consultant Consolidated Package

Frequently Asked Questions on MCA & ROC Filings

ROC Filing refers to the process of submitting various documents and forms to the Registrar of Companies (ROC) as required by the Companies Act, 2013. These filings are necessary to ensure compliance with statutory regulations and maintain the legal status of a company.

Non-compliance with ROC Filing requirements can result in penalties, fines, and legal consequences for the company and its directors. It may also lead to the company being classified as “inactive” or “dormant” by the ROC, affecting its ability to conduct business and access financial services.