TDS Return Filing Consultant

Are you looking for a TDS Return Filing Consultant? We provide TDS Return Filing services across India. Our team of TDS experts, including Chartered Accountants and Senior Advisors, is among the best TDS Compliance Managers in India. All individuals/companies required to audit their books of accounts are required to submit TDS Statements, primarily 24Q (Salary Return) and 26Q (Supplier TDS Return). Connect with us for your TDS Return Filing requirements.

Looking for TDS Return Filing Consultant?

TDS Return Filing

Tax Deduction at Source (TDS) is introduced to monitor financial transactions. TDS is deducted from the payment of vendors (Service Providers) and deposited to the Tax Department, mapping the PAN of the vendor. Thus, vendors can claim TDS as Tax Paid while filing their Income Tax Return. There are mainly two types of TDS Returns: 1. Salary TDS Return (Form 24Q) and 2. Supplier TDS Return (Form 26Q). TAN (Tax Deduction and Collection Account Number) is required for filing TDS Returns.

The tax deducted amount must be deposited via Chalan Payment. Such TDS payments must be made on or before the 7th day from the end of the month, and for March Month, the payment due date is 30th April. TDS Return submissions are required on a quarterly basis. The calculation of TDS, payment of tax, preparation of TDS Returns, and filing of TDS Returns are hectic processes. Furthermore, errors may lead to the revision of returns, which is also a hectic process. Any short payment and missed deductions result in the disallowance of expenses for the purpose of income tax. Additionally, Form 16 and Form 16A are required to be generated for each TDS deducted party. All in all, TDS compliance requires expertise. Our team of Chartered Accountants will perfectly analyze your requirements for TDS filing. Connect with us for TDS Return Filing Consultant Requirement.

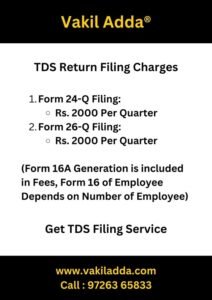

TDS Return Filing Fees

Our TDS Yearly Package Depends on Volume of Transaction and Employees. However, for Certain Medium Scall Business Our Pricing Model as TDS Return Filing Consultant are as

- Form 24-Q Filing: Rs. 2000 Per Quarter

- Form 26-Q Filing: Rs. 2000 Per Quarter

(Form 16A Generation is included in Fees, Form 16 of Employee Depends on Number of Employee)

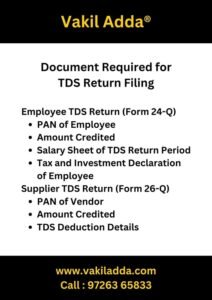

What Are the Documents Required for TDS Return Filing?

Following Documents required by TDS Return Filing Consultant for TDS Return Preparation

- Employee TDS Return (Form 24-Q)

- PAN of Employee

- Amount Credited

- Salary Sheet of TDS Return Period

- Tax and Investment Declaration of Employee

- Supplier TDS Return (Form 26-Q)

- PAN of Vendor

- Amount Credited

- TDS Deduction Details

Applicability of TDS

TDS provisions apply to companies or businesses when their books of accounts are required to be audited by a Chartered Accountant. However, the applicability of TDS on a particular payment depends on the nature of the service and the transaction amount. Let’s explore some important rules regarding TDS applicability:

TDS Compliance for Companies (Payers): Companies, individuals, or firms that are required to have their books of accounts audited must comply with TDS regulations.

TDS Deduction Requirements (Receivers/Employees/Vendors):

Employees (Section 192): If an employee’s earnings are taxable according to individual tax calculations, tax must be deducted based on their actual tax liability.

Professional Fees (Section 194J): TDS is applicable if the payment for professional services exceeds Rs. 30,000 per professional.

Interest (Section 194A): TDS at a rate of 10% is applicable if the interest amount exceeds Rs. 5,000.

Rent (Section 194I): TDS at a rate of 10% is required if the rent amount exceeds Rs. 2,40,000.

Contractor (Sec. 194C): For individuals and Hindu Undivided Families (HUFs), TDS is applicable at a rate of 1% (for others, it’s 2%) if the amount exceeds Rs. 1,00,000 or if a single transaction exceeds Rs. 30,000.

Commission (Sec. 194H): TDS at a rate of 5% is applicable if the commission amount exceeds Rs. 15,000.

- Other Payments: Consult with Vakil Adda Team for Rates and applicability.

- (TDS applicability varies from person to person, and tax deduction is required if the amount crosses the threshold during the financial year.)

Due Dates of TDS Compliance

Due Date of TDS Payment Deposit

- Month April to February: On 7th of Month (ie. For April TDS Payment, Due Date is 7th May)

- For March: 30th April

Due Date of Submission of TDS Return (Form 24Q and 26Q)

- Quarter 1 (April to June): Due Date is 31st July

- Quarter 2 (July to September): Due Date is 31st October

- Quarter 3 (October to December): Due Date is 31st January

- Quarter 4 (January to March): Due Date is 31st May

Our TDS Consultancy Service Includes

Our Comprehensive TDS Consultancy Service Includes following scope

- Calculation of TDS

- TDS Payment

- Preparation of TDS Return

- Filing of TDS Return

- Generating Form 16 and Form 16A

Process of TDS Return Filing

You need to send us data for preparation of TDS Return as per the type of return.

We will prepare TDS Return 24Q and 26Q as applicable.

After that, We will submit TDS return and Generate form 16A and form 16.

Complications of Non Compliance of TDS Provisions

Non-compliance with TDS (Tax Deducted at Source) provisions can lead to various complications for both the deductor (the person responsible for deducting TDS) and the deductee (the person from whose income TDS is deducted). Here are some of the complications that can arise due to non-compliance with TDS provisions:

Penalties and Interest: Non-compliance with TDS provisions may result in penalties levied by the tax authorities. Additionally, interest may be charged on the delayed deposit of TDS amounts.

Disallowance of Expenses: If TDS is not deducted or deposited on time, the expenses claimed by the deductor may be disallowed while calculating taxable income. This can lead to higher tax liabilities for the deductor.

Legal Consequences: Non-compliance with TDS provisions can lead to legal consequences, including prosecution under the Income Tax Act. The tax authorities have the power to initiate legal proceedings against the defaulting party.

Revised Returns and Rectification: In case of errors or non-compliance detected by the tax authorities, the deductor may be required to revise TDS returns and rectify the non-compliance. This can be a time-consuming and tedious process, leading to additional administrative burdens.

Increased Scrutiny: Non-compliance with TDS provisions may result in increased scrutiny from the tax authorities. The business may be subject to audits and investigations, leading to further disruptions and potential financial penalties.

TDS Return Filing Consultant

Consultant Name : Vakil Adda

Serving Locations: Across India, All Cities States

Consultant Contact No.: 9726365833

Email: office@vakiladda.com

Services: TDS Return Filing Consultant | TDS Return Filing Consolidated Package

FAQ's on TDS Returns

Yes, filing TDS Return online is mandatory for certain categories of deductors. However, exceptions may apply based on specific criteria and the jurisdiction of the Income Tax Department.

Assistance for filing TDS Return can be obtained from tax professionals, Chartered Accountants. We have team of CA who can assist you in filing of TDS Return Across India.