Latest GST Changes in India 2025: Updated Tax Slabs from September 22

Welcome to our blog! Today, we are going to talk about the Latest GST Changes in India 2025: Updated Tax Slabs from September 22. The Government of India has rolled out major updates to make GST simpler and more effective, including revised tax slabs, lower rates on essential goods and services, higher threshold limits for small businesses, a simplified return filing process, and sector-wise relief measures for MSMEs, healthcare, and education. Along with this, the new reforms also focus on reducing tax disputes, promoting digital compliance through upgraded GST portals, and offering more clarity in input tax credit rules. These changes are expected to not only ease the burden on taxpayers but also strengthen India’s overall tax system, making it more transparent, business-friendly, and growth-oriented.

Overview of GST Reforms September 2025

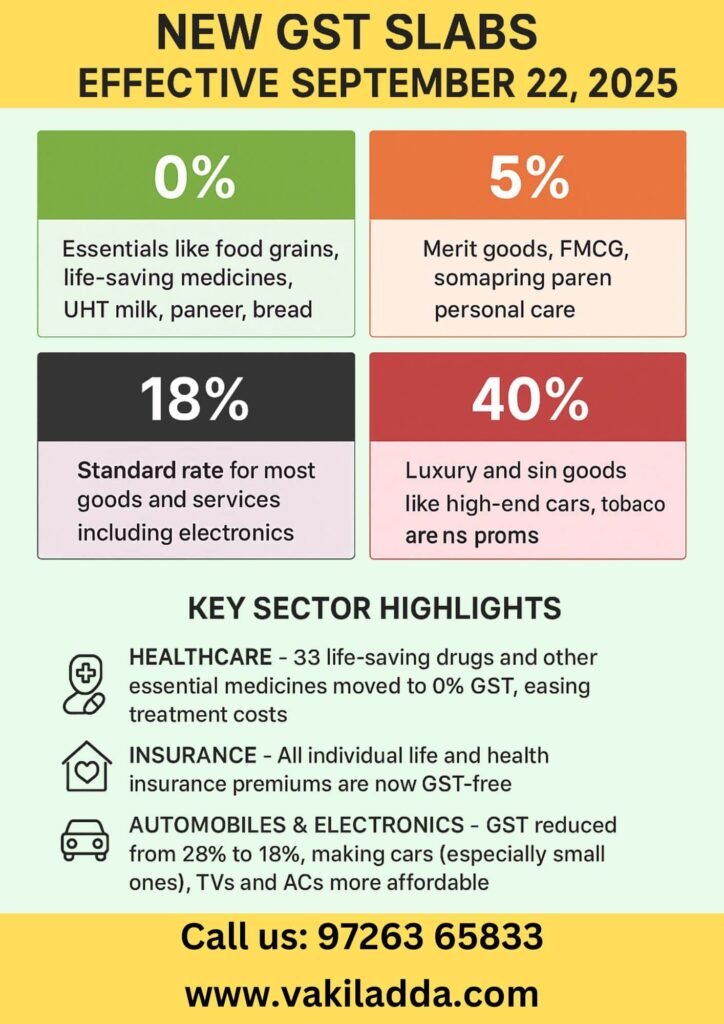

The September 2025 GST reforms mark one of the most important changes since GST was first introduced in 2017. The GST Council has simplified the tax system by reducing multiple slabs into just two—5% for essentials and 18% for most goods and services, with a special 40% rate for luxury and sin items like tobacco, aerated drinks, and premium cars. Essentials such as milk, paneer, bread, health insurance, and life-saving medicines have been made tax-free, providing huge relief to middle-class families. Meanwhile, consumer goods like TVs, ACs, cement, and small cars now fall into lower brackets, making them more affordable.

Apart from changes in rates, the reforms also focus on making compliance easier for businesses. A new simplified return filing system, faster refund process, and the introduction of the GST Appellate Tribunal are set to reduce disputes and ease the burden on taxpayers, especially MSMEs and startups. By streamlining slabs, removing GST on essential items, and making procedures more transparent, the government aims to boost consumption, encourage investment, and strengthen India’s economy ahead of the festive season.

Government’s Objective Behind GST 2025

Simplify GST rates – Only two main slabs now: 5% for essentials and 18% for most goods, plus 40% for luxury/sin goods.

Increase transparency – Easy-to-understand rates reduce confusion for both consumers and businesses.

Relief on essentials – Daily items like milk, paneer, bread, medicines, and health insurance are cheaper or tax-free.

Savings for middle class – Household goods such as TVs, fridges, ACs, cement, and small cars now fall under lower tax brackets.

Ease for small businesses – Higher turnover limits for GST registration and simplified filing system help MSMEs focus on growth.

Faster refunds – Especially useful for exporters and startups, improving cash flow.

GST Appellate Tribunal – Quick resolution of disputes without long delays in courts.

Digital upgrades – GST portal made more user-friendly with pre-filled forms and automated compliance checks.

Encourages consumption – Lower rates on commonly used products can push demand and boost the economy.

Revenue security – Higher tax on luxury cars, aerated drinks, and tobacco ensures government revenue stays strong.

Balanced growth – By easing burden on essentials and taxing luxuries, reforms aim to achieve “affordable for common man, premium for luxury buyers.”

Festive season benefit – Changes effective from 22nd September 2025 (Navratri) mean consumers enjoy cheaper prices right before Diwali shopping.

Key Highlights of the New GST Structure

The September 2025 GST reforms have reshaped India’s tax system into a simpler and more transparent framework, replacing the old multi-slab structure with three key categories – 5%, 18%, and 40%. Essentials such as rice, wheat, bread, milk, life-saving medicines, and education services have been brought under 0% GST, ensuring that the middle class and poor households get direct cost relief. The 5% slab is reserved for other essential daily-use goods, while most products and services now fall under the 18% standard slab.

At the same time, the government has introduced a 40% slab specifically for luxury and sin goods like tobacco, aerated beverages, premium cars, and high-end consumer durables. This ensures higher revenue without burdening essential sectors. To support businesses, especially startups and MSMEs, compliance has been simplified with easier GST return filing, digital upgrades like pre-filled forms, faster refund processing, and relaxed turnover limits for mandatory registration. Overall, the new structure makes GST more predictable for consumers, reduces disputes for businesses, and balances growth with revenue collection for the government.

Comparison with Old GST System (Before Sept 2025)

The September 2025 GST reforms replaced the earlier five-slab system with a clearer four-slab structure (0%, 5%, 18%, 40%). This change removes the overlapping 12% and 28% rates, making taxation simpler, more transparent, and easier to comply with. Consumers benefit through cheaper essentials and household items, while luxury and sin goods face higher taxation.

GST Slab Comparison with Examples

Old GST Slabs (Before Sept 2025) | New GST Slabs (From Sept 22, 2025) | Examples of Items (2025 Update) |

|---|---|---|

0% | 0% (Exempt) | Rice, wheat, milk, paneer, bread, life-saving medicines, school education, basic healthcare |

5% | 5% (Merit Goods) | Packed food items, edible oils, footwear under ₹1000, rail tickets, household essentials |

12% | Merged into 5% or 18% | Fans, small appliances, processed foods – shifted mostly to 18% |

18% | 18% (Standard Rate) | TVs, ACs, cement, mobile phones, small cars, hotel rooms below ₹7500, most services |

28% | Replaced with 40% (Luxury & Sin) | Luxury cars, SUVs, tobacco, aerated drinks, online gaming, gambling, five-star hotel rooms |

Key Takeaways for Users

Essentials cheaper: Daily-use food items, medicines, and education services are now fully tax-free.

Middle-class relief: Goods like mobile phones, cement, small cars, ACs, and TVs now fall in the 18% bracket (down from 28%).

Travel benefit: Economy rail and air tickets taxed at 5%, while premium/business class taxed at 18%.

Luxury buyers pay more: High-end cars, premium hotel stays, tobacco, and gambling now face 40% GST.

Business ease: MSMEs and startups benefit from higher registration thresholds, simpler filing, and faster refunds.

Zero GST Items Effective from September 22

Starting 22nd September 2025, the government has announced Zero GST on a wide range of essentials to reduce the cost of living and make healthcare, education, and financial protection more affordable. This is one of the biggest relief measures under GST 2.0.

✅ What’s Now Completely Tax-Free

Daily essentials: Fresh fruits, vegetables, pulses, rice, wheat, milk, paneer, bread, rotis, parathas, khakhra, pizza bread.

Healthcare & medicines: 33 critical life-saving drugs for cancer, diabetes, and rare diseases are now GST-free, along with most basic healthcare services.

Education: School tuition fees, notebooks, pencils, crayons, globes, maps, chalk, and sharpeners have been exempted to support students and families.

Insurance: All life and health insurance policies, including senior citizen and family floater plans, are exempt from GST—making protection cheaper.

Special relief: Items used widely during festivals (like paneer, sweets base ingredients) have also been exempted, giving families extra savings during the festive season.

🛍️ How This Benefits You

- Lower household budget: Everyday kitchen items are now tax-free → monthly grocery bills drop.

- Affordable medical care: Cancer treatments and chronic disease medication costs go down significantly.

- Education becomes lighter: Parents save on both school fees and study materials.

- Insurance for all: With no GST, more people can afford health and life insurance.

- Festive bonus: Zero GST on many food products helps families during Navratri, Diwali, and other festivals.

Sector-Wise Impact of GST 2025

The September 2025 GST reforms have reshaped the tax system with clear winners and losers across industries. Essentials and healthcare got relief, while luxury and high-end sectors face higher taxes. Here’s a sector-wise breakdown:

| Sector | Impact of GST 2025 | Details for Users |

|---|---|---|

| FMCG & Essentials | Relief due to 0% GST on food grains, milk, bread, paneer, parathas, fruits, and pulses. | Everyday groceries and kitchen essentials become cheaper, directly reducing household expenses. |

| Healthcare | Lower costs with 0% GST on 33 life-saving drugs and exemption on health insurance. | Cancer, chronic disease treatment, and medical cover premiums are now more affordable. |

| Real Estate | Higher GST on luxury housing & premium projects. Affordable housing kept at lower slabs. | Buying premium flats, villas, and luxury housing is costlier, while mid-income housing stays within reach. |

| Automobiles | Luxury cars & SUVs shifted to 40% slab (earlier 28%). Small & mid-range cars remain at 18%. | Common family cars get cheaper, but luxury vehicles are more expensive. |

| Startups & MSMEs | Simplified filing, higher GST registration threshold, and faster refunds. | Reduced compliance burden encourages small business growth and boosts digital filing. |

🔑 Key Takeaways for Users

Households win → cheaper groceries, medicines, education, and insurance.

Middle-class benefit → lower GST on small cars, electronics, and appliances.

Luxury buyers pay more → premium cars, 5-star hotels, and villas taxed at 40%.

Business relief → Startups and MSMEs enjoy simplified processes and compliance flexibility.

Benefits for Consumers and Businesses

The September 2025 GST reforms bring big relief for households and businesses. Essentials and healthcare are now cheaper, while filing and refunds have become faster. Here’s how it helps:

Consumers save money on essentials → Groceries like milk, rice, pulses, bread, paneer, and even medicines are now cheaper due to tax cuts. Small cars, soaps, toothpaste, TVs, and ACs also see reduced GST.

Boost in FMCG & healthcare → With 0% GST on life-saving drugs and food basics, families spend less, and demand in these sectors is expected to rise.

Businesses enjoy simpler compliance → One-time registration for e-commerce sellers, prefilled GST returns, and faster refunds make tax filing easier.

MSMEs and startups benefit → Lower input costs and a higher exemption threshold reduce financial stress, helping small businesses grow.

Festive season bonus → The reforms kick in from 22nd September (Navratri), cutting costs just before Diwali and boosting sales across sectors.

Exporters gain liquidity → With a new 7-day refund window, exporters will have faster access to working capital.

Economic growth push → Cheaper essentials for households + simplified processes for businesses = stronger demand, more jobs, and growth momentum.

Impact on Small Businesses & Startups

Faster GST registration in just 3 days.

Refunds processed within 7 days for exporters and startups.

Prefilled GST returns and auto refunds from October 2025.

Single GST registration for e-commerce sellers across all states.

Simplified GST slabs: 0%, 5%, 18%, and 40%.

Exemption limit raised to ₹60 lakh turnover.

Composition scheme limit increased to ₹2 crore.

Lower GST on fertilizers, tractors, and irrigation equipment.

AI-powered GST portal for error-free digital filing.

Quicker refunds and reduced paperwork improve cash flow.

Implementation Timeline for GST 2025

📢 Announcement → The GST Council announced the major reforms in early September 2025.

📅 Effective Date → The new GST slabs and rules officially came into force on 22nd September 2025.

🛠️ Transition Period → Businesses have been given a 3-month window to update their billing software, accounting systems, and compliance processes.

🏢 Support from Government → Helpdesks, FAQs, and GST Seva Kendras are set up across India to assist taxpayers during the transition.

🔄 Full Compliance Deadline → By December 31, 2025, all businesses must completely shift to the new GST structure.

Compliance Requirements for Businesses

Update accounting and billing software with the new GST slabs (0%, 5%, 18%, 40%) before the transition deadline (31st Dec 2025).

Train finance and accounts staff on prefilled GST returns, new refund rules, and revised slab structures.

Recheck HSN/SAC codes as many products have shifted between slabs (for example, essentials to 0%, luxury cars to 40%).

E-commerce sellers must shift to single GST registration and update compliance for multi-state operations.

MSMEs with turnover below ₹5 crore can now file GST returns quarterly instead of monthly.

Exporters and startups should track the 7-day refund window and maintain proper invoices to avoid delays.

All returns must be filed online through the new AI-powered GST portal for faster and error-free submissions.

Businesses must maintain updated purchase/sales records, e-invoices, and digital ledgers for smooth audits.

Revenue Implications for Government

The new GST 2025 structure is expected to bring mixed revenue outcomes for the government. According to official estimates, the initial loss could be around ₹48,000 crore annually due to rate cuts on essentials and reduced slabs. However, this is likely to be balanced by:

- 40% slab on luxury & sin goods (like tobacco, alcohol, premium cars), which is projected to generate significant extra revenue.

- Boost in consumption, especially in FMCG and healthcare, expected to add nearly ₹1.98 lakh crore to household spending.

- Better compliance & digital filing, which will reduce tax evasion and widen the tax base.

- Festive demand in late 2025, which CBIC believes will help recover any short-term fall in GST collections.

- SBI Research update shows the Centre’s net revenue loss could be as low as ₹3,700 crore in FY26, much smaller than earlier feared.

GST 2025 – A New Chapter for India’s Economy

The GST reforms rolling out on 22nd September 2025 are more than just a rate revision—they represent a shift towards a simpler, smarter, and fairer tax system. With essentials made cheaper and luxury goods taxed higher, the government is ensuring that relief reaches the masses while still safeguarding revenue.

For businesses, this means adapting quickly to digital compliance, streamlined slabs, and stricter classification rules. But the payoff is clear: smoother filing, reduced disputes, and a more transparent system.

In the bigger picture, GST 2025 sets the foundation for stronger household savings, thriving small enterprises, and healthier government finances. It’s not just a reform—it’s India’s next leap toward inclusive growth and long-term stability.

Your Trusted Consultant for GST 2025 Compliance

Understanding the latest GST reforms effective from September 22, 2025 can be challenging for businesses, especially startups and SMEs. From updating invoices to handling compliance under new slabs, companies often face confusion during transition. That’s where expert guidance becomes essential.

At VakilAdda.com, our team of professionals ensures hassle-free GST compliance for your business. Whether it’s filing returns, understanding new GST slabs, or sector-specific tax planning, we simplify the process for you. 📞 Contact us at +91 97263 65833 for trusted GST consultancy and smooth implementation of the 2025 GST changes.